On April 2, 2025, President Trump announced sweeping reciprocal tariffs on America’s trade partners to mark “Liberation Day”—the triumphant assertion of America’s industrial and economic independence.

Henceforth, Liberation Day should be celebrated alongside Independence Day every year. Why?

Over the last five decades America has offshored trillions of dollars worth of economic production—everything from basic necessities to cutting-edge technology—to rival nations. This has impoverished the American people and sapped America’s economic vitality.

Beyond this, we need to remember that economics and politics—money and power—are two sides of the same coin. Without economic independence, like the ability to manufacture steel, machinery, and semiconductors, there can be no political independence. As such, tariffs are not just an economic option—they are an existential necessity.

America’s founders learned these hard-fought lessons in the Revolutionary War, but somewhere along the way Americans lost this wisdom.

The greatest threat to the American Revolution was not the British, but the fact that the 13 colonies could not manufacture enough war materiel to fight back. After all, how can one win a war against Britain while buying their bullets? It was not until the French began supplying the Continental Army with over 80,000 firearms that the tide turned.

President George Washington recognized that political freedom flows from economic freedom, writing:

A free people ought not only to be armed, but disciplined; to which end a uniform and well-digested plan is requisite; and their safety and interest require that they should promote such manufactories as tend to render them independent of others for essential, particularly military, supplies . . .

President Washington’s first major piece of legislation was the Tariff Act of 1789. On the advice of Alexander Hamilton, who published his Report on Manufactures two years later, one of the Act’s purposes was to encourage the development of American industry.

Thomas Jefferson was initially critical of Washington’s plan, however, he changed his mind after the War of 1812 writing “experience has taught me that manufactures are now as necessary to our independence as to our comfort.”

America maintained the highest average tariff rate throughout the 19th century, under which the U.S. prospered and industrialized. By 1870 was the second largest industrial power in the world, behind only Great Britain, producing almost one quarter of the globe’s industrial output. By the end of World War II America was the world’s factory, producing half of all manufactured goods.

After the War, America’s leaders sought to rebuild Europe with the Marshall Plan, which granted Europeans asymmetrical trade benefits—Europeans could sell in America with minimal tariffs, while simultaneously protecting their industries from American goods with high tariffs. Over the next two decades, America’s trade barriers were chipped away, but the asymmetries remained.

For example, China joined the World Trade Organization in 2001 and gained access to America’s market. Meanwhile, American producers were not free to sell goods in China. To make matters worse, Chinese companies were subsidized by the state and were therefore able to sell goods at below-market prices—a business practice called dumping—until they killed American competition. Once the competition is dead, the Chinese reap monopolistic premiums.

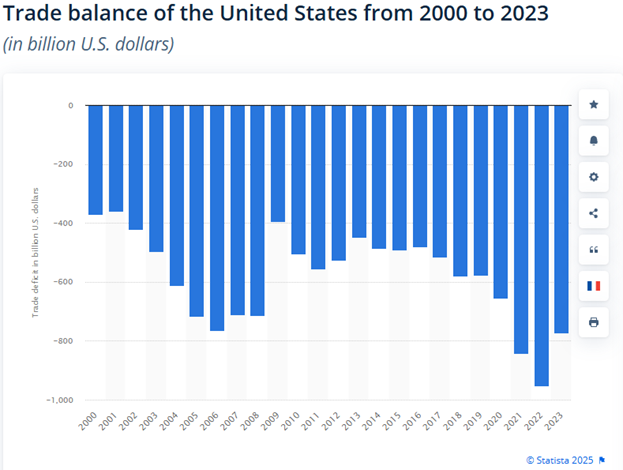

Asymmetrical trade—marketed as “free” trade—has led to America running trade deficits every year since 1974. In 2024, America’s trade deficit in goods and services was $918 billion. The cumulative value of the trade deficits, accounting for inflation, is over $25 trillion. This is the greatest transfer of wealth in human history—and how did America pay for it? By selling assets and debt.

An asset is something made in the past that retains value today. A good example of an asset is a house. Building a house in 1973 would contribute to GDP in that year, but not today. However, the house retains value and could be sold at the present time to buy imports.

America sells tremendous amounts of real estate to fund the trade deficit. For example, in 2024 foreigners bought an estimated $42 billion of residential real estate, $8 billion of agricultural land, and $12 billion commercial real estate. For Americans, this raises the cost of shelter, which is the primary reason why the median American household now spends more on needs (food, clothing, and shelter) than wants (everything else) than at any time since the 1960s.

In addition to real estate, Americans also sell ownership of businesses. As of June 2023, foreign investors own 17 percent of all American equities. Foreign ownership of our businesses often has dire consequences, such as giving foreign businesses and governments direct access to technology. This facilitates intellectual property theft worth up to $600 billion per year.

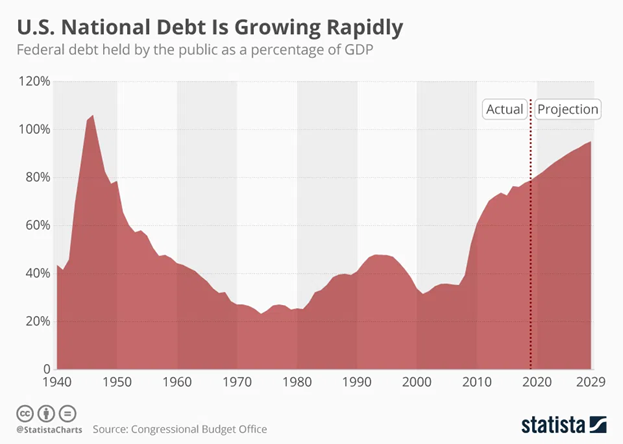

America also sells debt. For example, foreigners own some $8.67 trillion of U.S. Treasury securities, accounting for 24 percent of the public debt. Further, America’s corporate and household debt has ballooned since 1973 to the highest levels since World War II.

Debt is especially dangerous because we must repay the principal and interest. This inflates the cost of buying foreign products. Consider that America became a debtor nation in 2006—for the first time since the Great Depression. As a result, America pays over $150 billion in interest every year to foreign entities for the privilege of buying the products we should be building ourselves.

America is essentially buying groceries by pawning grandma’s wedding ring and racking-up credit card debt. Consuming more than you produce is fundamentally unsustainable—on a personal or national level. Not only does this reduce America’s GDP—rather than build it, America buys it—but this process generates a consumption bubble that destabilizes the market.

Tariffs can solve the above problems by making America’s trade relationships symmetrical. This will create opportunities for American industry by opening up foreign markets, and protecting America’s markets from unfair foreign competition. Ultimately, this will result in reshoring America’s industry, which will restore the middle class and revive the American Dream.

Asymmetrical trade also endangers America because of something called import dependency. This occurs when a country relies on foreign countries to supply it with a critical resource or product. America is now import dependent on China—and not just to maintain her luxuries, but to maintain even its economic functionality.

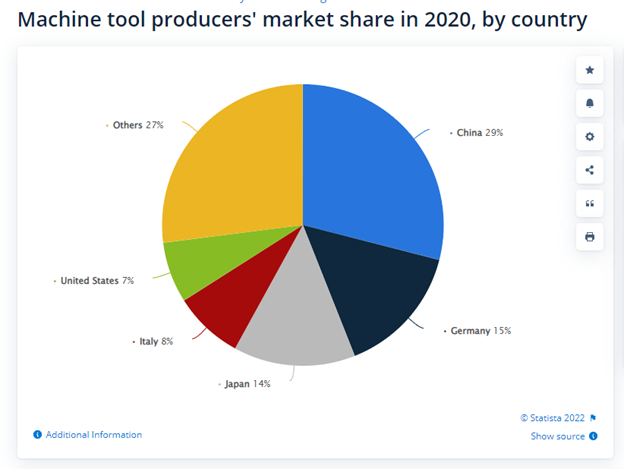

For example, America is largely import dependent for machine tools. A machine tool is a piece of machinery that shapes its output by removing material by way of lathing, planing, drilling, milling, grinding, sawing, or pressing the output. Machine tools transform raw materials into something useful. They are the machines that make more machines, and powers the economy’s reproductive system.

America used to be the leading manufacturer and global exporter of machine tools. Today, America imports most its machine tools, producing just 7 percent of global production. For comparison, Italy produces 8 percent and China 29 percent.

This endangers America’s national security: imagine if a hot war broke out. It is likely that global supply lines would be disrupted. In that case, how can America scale-up industrial production? Not only does America lack the industrial capacity to do so, she lacks the machines to create such a situation.

To make matters worse, America is becoming increasingly dependent on imported technology. For example, America imported $763 billion worth of advanced technology products in 2024. America bought the future she should be building.

Again, this clearly endangers our national security. Consider that the modern world runs on computers—silicon chips. America imports far more chips than she produces. Accordingly, America depends on Taiwanese chip makers. This makes America vulnerable, especially given Taiwan’s proximity to China.

Unfortunately, just as with machine tools, the rot is deeper than it first appears. Not only does America rely on foreign chips, America does not actually manufacture the photolithography machines required to print the chips. Those come from the Netherlands, are shipped to Taiwan, and the chips are finally shipped to America. In short, America’s entire modern economy depends on foreign manufacturers.

The analysis offered can be conducted for just about any critical product: America depends on imported steel, ball bearings, automobiles, and oceangoing ships. Embarrassingly, China built 100 times as many oceangoing vessels as did America in 2023.

America’s founders learned their country could not protect her political independence without maintaining her economic independence. This is why President Trump’s tariff policy—why Liberation Day—is so important.

Reshoring America’s industry is not just about growing the economy and reviving the middle class—it is a question of existential importance. How long can America remain an independent country when she depends on China for her basic survival?

Leave a Reply