The United States is a nation of debtors. Whatever sources you consult or trust, our per capita debt is extraordinarily high. The money geeks at NerdWallet.com, after analyzing statistics from the Federal Reserve, offer the following profile of American households:

Average credit-card debt: $15,270

Average mortgage debt: $149,925

Average student-loan debt: $32,258

I shall not insist upon this or any set of numbers. Unfortunately, an average is often a meaningless and irrelevant number. If Carlos Slim walked into a homeless shelter to buy Christmas dinner for 20 winos, their per capita average net worth would be measured in hundreds of millions of dollars. The high credit-card debt figure, for example, is affected not only by a comparatively small number of households with very high debt but by eliminating households without any credit-card debt. Even the lower figure of $7,123, which includes households with no credit-card debt, is grim enough. Though President Obama’s lobbyists in the media like to celebrate the decline in credit-card debt, that appears to be more a case of people defaulting rather than paying off their cards.

Business reporters and economic forecasters sometimes speak of “slicing and dicing” the numbers, but Fed statistics strike me as more processed, puréed, and amalgamated until the characteristics of real people disappear. A more meaningful set of figures could be used to profile the household debt of a middle-class homeowning family of three in a more or less average state like Iowa or Tennessee. The Federal Reserve uses a lowball definition of the middle class—households with an annual income of $35,600-$94,600—and estimates that three fifths hold a mortgage, the average debt being $104,000. If to this high figure or figures, we were to add in the per taxpayer share of the national debt owed by a family of three, we are up to roughly one million dollars even before we start calculating interest.

Condemnation of Americans’ personal debt is almost always framed in exclusively economic terms, especially on talk radio, where listeners are invited to call in and proclaim (on the Dave Ramsey Show, they actually scream) their freedom from debt. I can well understand their sense of relief. Let us suppose a modest household that holds a $100,0000 mortgage and owes $50,000 on student loans and an equal amount to the bank that issued their credit card. Rates vary, of course, but in a year they might pay interest of $5,000 on their mortgage, $2,500 on student loans, and $9,000 on credit cards, for a total of $16,500. Even half that amount could be put to better use than to enrich the usurers, a class of men universally despised in civilized societies.

The economic consequences of debt, however, are minor compared with the moral and political evils suffered by debtors. In some societies, a debtor might lose not only his house and farm but his and his family’s liberty. During a period of economic crisis in ancient Athens, poor farmers hypothecated their land, and when they lost the land, they ended up as bondsmen. It was Solon’s greatest boast that he had liberated the land from the mortgage stones and freed Athenian citizens from bondage to aliens. He was the savior of the commonwealth, but he did not change the eternal reality that long-term indebtedness is slavery.

English literature is filled with tales of thriftless or merely unfortunate young men who fell into the clutches of the moneylenders. In The Merchant of Venice, the pound of flesh that Antonio owed to Shylock is a fictional metaphor for the very real slavery into which a debtor might fall. When a man’s house was truly his castle, debtors, if they had the means, might suffer no worse fate than to be confined to their own houses, where no bailiff or debt collector could disturb them. If they were caught on the street, however, they could be put into a prison from which they would only be released when their friends put up sufficient funds to pay off the shylocks.

Slavery for debt and debtors’ prisons have both disappeared from the American and European scenes, though I do not know how else to describe the recent arrest and jailing of a young woman in Pickens, South Carolina, for failing to return a video she had rented in 2005 from a store no longer in business. In other equally enlightened communities, people have been rounded up for unpaid library fines and unpaid tax bills.

These odd cases aside, there remain forms of debt-slavery that may be more subtle, though no less pernicious. If you owe money to someone, you are to some extent in the creditor’s power. On a small scale, the creditor can take you to court, but if you owe money to a powerful entity, such as the government or your employer, your freedom of action is at risk. In Merle Travis’s famous celebration of tough coal miners, the singer (Tennessee Ernie Ford) laments, “I owe my soul to the company store,” which had supplied the miner with various supplies on credit. A similar system has been applied to agricultural labor and sharecropping. An indebted worker or cropper is not free even to pull up stakes and go to another job.

To understand how far we have come down the broad highway of debt, try to imagine the Freemans, a middle-class American family of 100 years ago. If they owned a house, they owned it outright or had only a small short-term loan from the bank. If the father were a physician or a lawyer, he either owned his practice or was in a partnership. His wife stayed home, took care of the children, and, aided by two or three part-time helpers, supervised the housekeeping. For entertainment, the Freemans read, played games, performed music on the piano or on whatever instruments they had studied, and spent hours talking to one another.

Their latter-day counterparts, the Owens family, are deeply in debt to pay for a house far greater than they need; since Mrs. Owens has to work to pay for the family’s three vehicles—her Beemer, his Jeep Grand Cherokee, and their SUV—as well as their costly vacations at Caribbean resorts, the children are deprived of the benefits of a full-time mother, and the family goes ever deeper in debt, buying flat-screen television sets and every piece of mind-destroying junk that the evil ghost of Steve Jobs can devise.

The difference between the two families is the difference between freedom and debt-slavery. Ezra Pound put it succinctly: “There is NO freedom without economic freedom. Freedom that does not include freedom from debt is plain buncumb.” A little later in the same piece, Ol’ Ez opines, “Debt is the prelude to slavery. And you are now [in 1943], I ’spose, arrived at the intermezzo. America WAS promises. America today is largely, shall we say, promissory notes that simply can NOT be honored.”

Pound was prescient, but he scarcely could have imagined two generations of Americans who would sell themselves into debt-slavery for the sake of shoddy consumables made in Asian sweatshops. He did, however, understand what as an aspiring financial planner I learned to call “the miracle of compound interest.” Of course, the creditor (or investor) thinks only of the rapid accumulation represented by the penny a day doubled for a year. He never stops to wonder if someone else is not having to pay for the miracle. Pound would have used a simple word for the rates of interest charged by commercial lenders today (18 percent plus accumulating penalties and higher rates for late payment): usury.

The moral problem of usury goes well beyond the mere fleecing of suckers. Usury sucks not just the people’s money but their vitality:

With Usura hath no man a house of good stone,

Each block cut smooth and close fitting.

In condemning usura, Pound was not restricting his indictment to usurious rates of interest but to an unnatural economic system based on breeding money from money, as Aristotle described it. Of course, Aristotle, Saint Paul, Saint Thomas, and Dante were not thinking of our world, where it is reasonable to expect to gain a return from investments that encourage the growth of businesses and to receive interest that indemnifies the lender for lost opportunities.

If Aristotle or Saint Paul were to visit the 21st century, they would certainly despise the moneylenders and stockjobbers who manipulate economies and ruin individuals, families, and even nations in order to satisfy their nasty greed, nor would they be much impressed by the equally pernicious activities of such nonprofit conspiracies as George Soros’s Open Society Foundation, which has funneled both Soros’s and the U.S. taxpayers’ money into schemes to destroy religion, morality, and civilization. However, like Pound, the philosopher and the apostle would probably be even more horrified by an entire economic, cultural, and social system in which getting rich is the highest value and where craftsmanship, beauty, justice, and friendship are only words used to snooker the unwary.

Pound pushes the argument even further, to equate usury with the diabolical forces of sterility and death: “Usura slayeth the child in the womb / It stayeth the young man’s courting.” Is this insanity or does it mean something? Pound appears to be talking about abortion, contraception, and postponement of marriage for economic motives. More broadly, he is condemning the unfruitful and uncreative lives that are devoted to getting ahead. He was not opposed to business or even banking—he praises the Sienese bankers who invented a system of responsible and honest banking. He is talking quite deeply about our moral commitments.

Like Saint Paul, who often lumps usury with sodomy, Pound equates greed and usura with unnatural sex. If he were writing today in a Marxist lingo, he might speak of the commodification of sex and marriage. Weddings are no longer affairs of church, family, and friends; they are Vegas productions set in romantic destinations that have no connection with the couple’s past or future lives. Far from being a means of connecting man and wife with their communities, they are an escapist fantasy, a licensed “sexcapade” that is the erotic equivalent of winning the lottery.

The average cost of a wedding in the United States is now over $28,000, and I have read of young couples who take on a debt of $50,000 to pay for a wedding, knowing full well that their marriage, if it conforms to the eight-year average duration, may be dissolved before the loan is paid off. This sickness is not the moral disorder of the lottery winner who goes on a spending spree: It is the disease—moral and spiritual—of children who sneak into the parents’ closets and open up the presents because they cannot wait for Christmas, the annual celebration of greed that has almost completely replaced the feast of Christ’s Nativity.

Christians have a particular motive for avoiding indebtedness, a condition that Jesus equated with sin. “Forgive us our debts,” He tells us to pray, “as we forgive our debtors.” The Book of Common Prayer’s more familiar “forgive us our trespasses,” though it is a justifiably broad interpretation, obscures the metaphor. When we steal a man’s money or seduce his wife or destroy his reputation, we put ourselves in a position of obligation to him, analogous to a debt. This debt, as Luke has it (11:4), is a sin.

But if sins and transgressions are a kind of debt, then debts, until they are paid back, can be viewed as a kind of sin. The great Protestant moral theologian Richard Baxter, in discussing whether or not it is a sin to steal bread for a starving family, says that necessity can only justify the theft if the thief intends to make restoration and carries out that intention. As an independent with puritanical leanings, Baxter was a notoriously severe casuist, and one might wish to add some nuance to his blanket condemnation, but his point is well taken: The man who steals or borrows, without doing his best to pay back the victim or creditor, is in a state of sin that no bankruptcy proceeding or federal amnesty can affect.

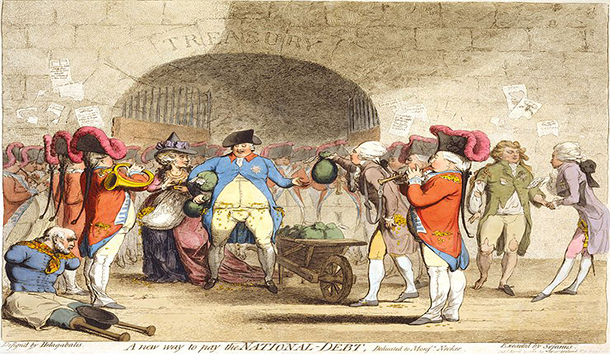

Persistent indebtedness is, then, a symptom not only of dependency and hedonism but of a sinful disposition. In earlier times, private citizens and their rulers, if they refused to live within their means, were given harsh names: They were spendthrifts and wastrels, profligates and prodigals. Hogarth’s famous set of paintings A Rake’s Progress depicts the fortunes of a wealthy heir who begins as a spendthrift wasting his money first on wine, women, and song (G.F. Handel!). The rake turns to gambling, and ends bankrupt and mad in Bedlam. If the common sense that Hogarth illustrated is correct, as it certainly is, then a nation of debtors is really a national lunatic asylum.

Every pundit in America has a set of remedies to be undertaken by Congress, the White House, and the Federal Reserve, but a system based on debt cannot reform itself, if only because none of the parties involved could make a move toward freedom from debt without undercutting its own ability to loot the taxpaying citizens. The task cannot be left up to government, because slaves to debt will never persuade their masters to set them free. “A slave,” as Pound reminds us, “is someone who waits for someone else to free him,” and if we would not be slaves, we must begin by freeing ourselves.

Leave a Reply