As has become painfully obvious since Oct. 7, you should dismiss everything coming out of the Ivy League these days if you want to stay sane. Well, almost everything. A recent warning from the University of Pennsylvania about the national debt reminds us of the dangers of blanket dismissals.

Forget about former U Penn President Liz Magill, who immolated herself in Congress with her smug remarks in response to Elise Stefanik’s imitation of Torquemada the Grand Inquisitor. Instead, take a look at the recent Penn Wharton Budget Model (PWBM) publication showing how the United States will soon immolate itself and the rest of the world under its mountain of unpayable debt. Magill resigned in shame as Penn’s president. She then slithered back to her teaching position at Penn’s law school after Stefanik’s politicized inferno burned itself out. Unfortunately, the United States will have no such escape hatch after its very own unforced debt conflagration.

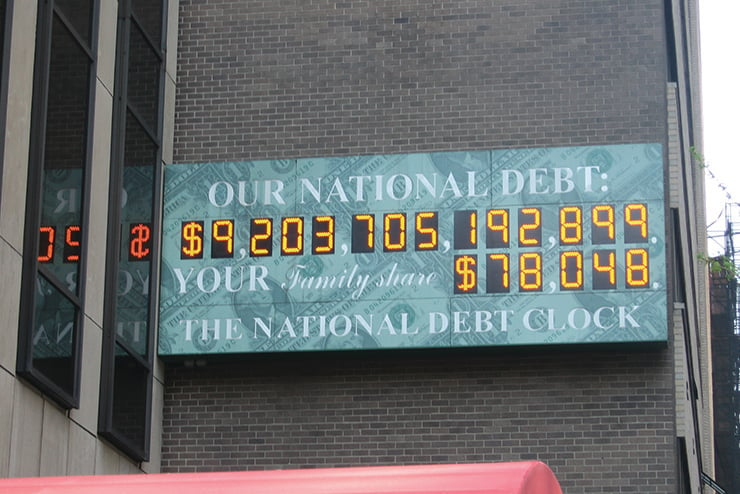

Unlike the smug Magill, the PWBM wastes no time gaslighting its audience. Its conclusion regarding America’s staggering $34 trillion national debt is equal parts terrifying, inevitable, and obvious:

Under current policy, the United States has about 20 years for corrective action, after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt.

The authors estimate the U.S. debt held by the public can’t exceed 200 percent under “today’s generally favorable market conditions,” i.e., historically low interest rates and a functioning economy. The United States’ precarious balance sheet could lead to disaster even sooner than the rosy 20-year scenario. Financial markets may start to doubt the federal government’s unsustainable “debt dynamics,” which need only a little economic weakness before they start to unravel.

The PWBM reminds us that as government debt expands, it “crowds out” private capital formation, the lifeblood of economic activity. Crowding out then leads to lower GDP growth and a smaller tax base, which factor into a government’s creditworthiness. Japan’s national debt exceeds 200 percent of its GDP today. But Japan’s high household savings rate—23.7 percent last November—funds its outsized borrowings. The United States’ 3.7 percent household savings rate shows where American consumers’ priorities lie.

Those who dare to read beyond the PWBM’s summary will be punished for their curiosity. The 200 percent debt-to-GDP ratio will only persist as an “outer bound using various favorable assumptions.” The “more plausible value,” 175 percent debt-to-GDP, isn’t even all that plausible according to the PWBM, as that lower ratio bakes in the financial markets’ wing-and-a-prayer hope that the government “will eventually implement an efficient closure rule” to shrink the debt. The previously mentioned unraveling can occur at even lower debt-to-GDP ratios (today’s 120 percent anyone?) as soon as financial markets stop dreaming.

Perhaps you are not worried, because Chuck Schumer hasn’t mentioned any of this on MSNBC. But there’s more. “U.S. debt is on a secular upward path,” the PWBM reports—a fact that even Schumer, McConnell, and the non compos mentis Joe Biden would have to admit as they salivate over how much more debt we should incur to protect the borders of Israel, Ukraine, and Taiwan. But since they aren’t students of history, that spendthrift trio should read the PWBM to learn that “past projections have … underestimated that increase” in our debt’s secular growth.

Sadly, they don’t care. And they don’t care because their constituents and, more importantly, their donors don’t care. The median net worth of Americans between 65 and 74 almost doubled to $410,000 in 2022 from $210,000 in 2010. But how many retirees in the lucky half above the median told their senators to cut their Social Security benefits so as to not destroy their grandchildren’s’ future? One could almost forgive Schumer and Biden’s profligacy, provided they wasted our money in America on Americans, instead of overseas.

Twenty years ago “seems like yesterday,” according to the cliché. But remember that communism collapsed 33 years ago and 9/11 was 23 years ago. Our bleak future will arrive in no time if the PWBM’s report is even half-right. Our ineluctable national debt default will go down as the most foreseeable disaster in the United States’ history. The actuarial tables tell us Schumer, McConnell, and Biden probably won’t live to witness the unraveling on the off chance we make it the full 20 years. Even worse, should it all unravel sooner, our nation’s fate will be in their incompetent hands.

Leave a Reply