As both Drutman and Katz emphasize, before the 1970’s lobbying in America was a paltry enterprise. In the immediate postwar era, under the pro-business Eisenhower and Kennedy administrations, few companies hired in-house lobbyists; instead, they worked through trade associations or independent lobbying firms. Under Lyndon Johnson regulatory legislation addressed a host of social and economic issues, while Ralph Nader emerged as the nation’s leading antibusiness activist. Corporate America, however, was slow to react to the government’s more aggressive posture. Only by the late 70’s did any significant growth in lobbying become evident. Drutman notes that, as the budget “for federal regulatory agencies [rose] from $1.5 billion to $4.3 billion” between 1971 and 1975, corporate America seemed paralyzed. But leadership provided by trade groups such as the National Association of Manufacturers gradually awakened corporate heads to the need for establishing an aggressive presence in Washington. By 1981 the number of firms with lobbyists in the capital rocketed from 171 to almost 2,500, while the number of firms sponsoring political action committees quadrupled. During the Reagan years, lobbyists sought actively to influence policymaking at every level—a strategy that paid big dividends (as in the case of the 1981 Economic Tax Recovery Act, which ensured a huge $169 billion payoff to big-business interests). In the mid-to-late 1990’s, as the debate over the Clinton healthcare plan heated up, the share of companies with a Washington presence began to rise again. While lobbying expenditures declined slightly during the recent Great Recession, the overall pattern has been one of enormous expansion. According to Drutman’s most recent figures, 3,587 companies in 2012 spent a combined $1.84 billion on lobbying efforts, which doesn’t include expenditures paid out to trade associations or the hard-to-assess spending on “shadow” lobbying, which, if labeled as “issues management” or “strategic advising” or “public relations,” need not be reported under the 1995 Lobbying Disclosure Act. Meanwhile, lobbying by “diffuse interest groups” has declined drastically relative to business lobbying.

While lobbying expenditures by individual companies today outstrip by far those of trade groups, one notable exception is the U.S. Chamber of Commerce. Like a bloated spider at the center of a vast web, the Chamber sponsors a host of political initiatives that reach well beyond “lobbying” in the usual sense of the term, but on lobbying alone the Chamber spent over a billion dollars between 1998 and 2013. Founded in 1912 at the initiative of Howard Taft, the Chamber was intended to be “broadly representative” of American business interests. It was to function on a national level much as local chambers of commerce had functioned in their communities for over a hundred years, but with the additional mandate to work with Congress to shape public policy on regulatory issues. Its membership was to consist not of individuals but of local chambers, trade groups, and companies whose representatives would formulate the Chamber’s positions democratically. While Katz devotes several chapters of her book to the early years of the organization, the Chamber’s political influence before the 1970’s was negligible. That began to change when, in 1975, under the leadership of Julius Lesher, the Chamber borrowed a page from the Nader playbook and launched a “grassroots” initiative to fight the wave of regulatory mania on Capitol Hill, primarily through the agency of mass mailings (which had already worked so well for consumer advocacy groups). The Chamber was prohibited by IRS rules from organizing political action outside the ranks of its own membership. Thus in 1976 was born Citizens’ Choice, a nonprofit front group housed in the Chamber’s Washington headquarters but legally independent and free to engage in extensive mobilization and direct mailings that would reach “millions of . . . housewives, teachers, professionals, businessmen and retired citizens” who would, in turn, besiege their congressmen with letters and phone calls demanding lower taxes and fewer regulations—in effect, transforming all these ordinary citizens into unpaid lobbyists. As Katz notes, there was nothing genuinely “grassroots” about Citizens’ Choice. Many of the “citizens” in question were simply employees of Chamber member companies, and “some simply signed up their employees . . . whether they wanted to or not.” Interestingly, Citizens’ Choice was chaired by Jay Van Andel, CEO of Amway, a company that has over the years been repeatedly accused (with some justification) of deceptive marketing practices. Not surprisingly, Amway served nicely as a “recruiting hub” for Citizens’ Choice, “encouraging its 300,000 distributors to enroll.”

Such tactics were raised to a fine art under Lesher’s successor, Tom Donahue, whose affiliation with the Chamber began with his appointment as executive vice president at Citizens’ Choice, after which, until 1984, he remained the Chamber’s chief attack dog in Washington. After a stint as CEO of the American Trucking Association, he became president of the Chamber in 1997. Donahue has turned the Chamber into a lobbying juggernaut, but his advocacy for American business interests has been, from the beginning, skewed in favor of Big Business—that is, those corporate clients with the deepest pockets. He was among the most vociferous supporters of NAFTA, arguing that such trade agreements would boost productivity (though, in fact, productivity had been steadily rising since 1979) at a time when American workers’ wages had stalled or were, in some sectors, declining. Among the Chamber’s more lucrative corporate friends were Philip Morris and R.J. Reynolds. When John McCain introduced a bill in 1998 that would have raised taxes on cigarettes, the Chamber spent $100,000 on attack ads, the funds having been funneled by Philip Morris through the Chamber’s “revitalization project.” Subsequently, hundreds of thousands in Big Tobacco dollars would be passed to the Chamber by way of “proxy organizations” in what Katz calls a “turning point in Donahue’s quest to turn the Chamber into a money machine for lobbying on behalf of big corporate clients who preferred to stay behind the scenes.” Today, as a visit to the Chamber’s website reveals, its board of directors consists of almost 100 corporate high-rollers, including CEOs and CFOs from companies like FedEx, Pfizer, Mesa Capital, and a host of others in the same league. The Chamber couldn’t even begin to pay its enormous staff and its armies of lobbyists on the income from its dues-paying members, so draw your own conclusions about where all the dollars are coming from.

If there were any doubt that the pervasive lobbying influence in Washington is fueled overwhelmingly by megacorporations, consider Drutman’s figures from just before the Great Recession put a slight damper on corporate spending. He shows that of the 4,496 companies spending money on lobbying in 2007, only 262 were in for more than a million in expenditures. Among the top 20, all of them spent at least $9 million, and the top five more than $16 million each, and these were just reported expenditures. Those companies (GE, Altria Group, AT&T, Exxon, and Amgen) spent almost $100 million lobbying on nearly 500 bills involving taxes, tobacco, telecommunications, energy, Medicare, Medicaid, and health issues. The corporation employing the largest number of lobbyists (though its expenditures were a modest $12.7 million) was Verizon. Microsoft, Boeing, and IBM were all big spenders as well. Of course, the companies in the top 20 vary from one year to the next, depending upon the political and legislative climate. In 2015 GE, AT&T, and Boeing all remained on the list, but it should be noted that last year’s biggest spender by far was the Chamber of Commerce, which doled out a whopping $84 million. One should not imagine, however, that all the well-heeled lobbyists on the Hill spend their days greasing the palms of elected officials or shadowy bureaucrats with dirty money. That does happen, of course, but the real corruption is more complex and, in its way, far more disturbing.

One of the virtues of Drutman’s study is that he demonstrates how lobbying has become a virtually self-perpetuating enterprise that ultimately favors the most powerful players and the status quo, making real policy change ever more difficult. His argument is simple enough: As companies invest in lobbying, managers become more savvy about the political environment; they recognize that in the complexity of the current regulatory environment, they have much to lose by failing to maintain a Washington presence. Moreover, they understand that the more feet they have on the ground the better, if only to prevent potentially damaging bills from ever reaching the congressional floor. Over the long term, lobbyists themselves become entrenched and acquire policy expertise that outstrips the knowledge of overworked congressional staffers (many of them young, underpaid, and inexperienced) who come to depend upon lobbyists for the expertise that they lack—especially since it is often quite difficult to find alternate sources of information. Thus lobbyists today are increasingly involved in the crafting of policy itself. Nor is it any surprise to find that congressional staffers frequently migrate out of congressional offices to become lobbyists, a practice suggesting that more insider trading transpires inside the Beltway than on Wall Street these days (the trading of favors, that is).

Drutman’s chief contention is that lobbying is a “sticky enterprise,” meaning that lobbying perpetuates more lobbying because, in the first place, politics is an ambiguous and uncertain business. Lobbyists are in the unique position of being able to “pick and choose” the facts they report to their corporate managers, to create “narratives” that are reassuring and which seem to cut through the ambiguity. Managers are far away, while lobbyists have a finger on the Beltway pulse. This gives lobbyists greater freedom to overstate the effectiveness of their influence. Moreover, lobbyists understand that influence peddling is a highly subjective endeavor. It isn’t difficult for a skillful lobbyist to persuade less knowledgeable CEOs that tactical variation is the name of the game, which means more lobbying initiatives and more lobbyists. Over time, at least for the more powerful companies, lobbying becomes habitual and proactive. Major corporations install “government affairs departments,” which “socialize political activity into the corporate culture.” Earlier analyses of the growth of lobbying viewed it primarily as the result of the growth and attention of government. As government expands, the regulatory web proliferates and more government contracts become available. Interested businesses and agencies naturally respond with more lobbying. Drutman doesn’t find this correlation altogether convincing. He notes that, if one examines the growth of government on a year-to-year basis, lobbying does not always increase in those years when expansion is most vigorous. He avers repeatedly that only the “self-perpetuating” nature of lobbying can fully explain its amplification in recent decades. Of course, there is no doubt that lobbying is a “sticky” enterprise, and Drutman has performed a valuable service in demonstrating at length just how important this factor is.

Nevertheless, it is difficult to see how a lobbying industry of any significant size could emerge outside the context of the long-term growth of the regulatory state. Nor should it be forgotten that a great deal of lobbying is generated by the competition for federal contracts, grants, and loans. According to usaspending.gov, federal contracts and grants have averaged around $500 billion per year since 2008; when loans are thrown into the mix, the figure rises into the trillions. Such largesse can only be explained by the rank proliferation of government, which in turn fosters a parasitic reliance on the federal treasury in large sectors of our economic life. Neither Drutman nor Katz seems to fathom the deeper political implications of all this. Over 70 years ago James Burnham, in The Managerial State, foresaw the rise of a new elite that would displace the old capitalist ruling class (with its distrust of the centralized state) and preside over a fusion of government and economy. This would not be, he insisted, a socialist state. In the managerial regime, the economy would remain largely under private ownership and, at least nominally, capitalist; but in both corporate and governmental spheres, the shared ideology of the managerial class would ensure that the two would increasingly come to resemble each other, to share the same social values, and to coordinate their operations. In the economic realm, large, bureaucratic entities would come to dominate government attention, leaving small businesses all but powerless. While not all of Burnham’s predictions have been fully realized, the explanatory reach of his conception is quite powerful. Indeed, it is the best framework we have for understanding the power of the lobbying industry in America today. Lobbyists occupy a unique and powerful middle ground between business and government, and facilitate the slow-motion fusion of the two.

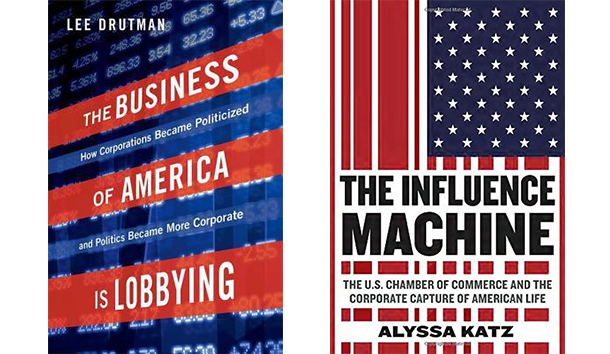

The Business of America Is Lobbying: How Corporations Became Politicized and Politics Became More Corporate, by Lee Drutman (New York: Oxford University Press) 269 pp., $29.95]

[The Influence Machine: The U.S. Chamber of Commerce and the Corporate Capture of American Life, by Alyssa Katz (New York: Spiegel & Grau) 315 pp., $28.00]

Leave a Reply