There may be no more pitiful sight than that of tides of impoverished and starving refugees; there may be no greater irony than grievous want in the Third World amidst exploding possibilities in the First. Nearly a quarter of the world’s population lives on less than one dollar per day. More than half survives on less than two.

These images and numbers may help explain the Bush administration’s support for the Millennium Challenge Account (MCA), despite former treasury secretary Paul O’Neill’s oft-expressed criticism of foreign aid. And even though terrorism has nothing to do with poverty, Washington is gripped with a desire to “do something” after September 11.

Yet the case for skepticism of foreign aid is as valid today as it was on September 10, 2001. Such distrust has nothing to do with isolationism, the term of opprobrium routinely tossed at anyone who criticizes an international initiative. Instead, it reflects a hardheaded analysis of reality.

Over the last two decades, the United States has provided $167 billion to 156 developing states. In the 97 for which reliable data is available, median per capita GDP has fallen 7.6 percent. It is hard to believe that tossing an extra five billion dollars annually into the MCA, as President Bush proposed, will yield any change. Indeed, Secretary of State Colin Powell’s description of Africa as “clearly emerging as a continent of promise” is, at best, a politically correct delusion. The man-made famine in Zimbabwe is but one example of how governments intentionally wreck their nations for political gain.

The term “foreign aid” encompasses a host of programs with political, military, and humanitarian goals. The most important form of government “assistance” is the least justified: economic or development aid. It was created when people believed the Third World was poor because it lacked money. Today, we know that is not true.

Even during the Cold War, most aid was officially intended for development. The result has been an expensive wasteland. For instance, Zaire received some $8.5 billion from a multitude of sources between 1970 and 1994 but still imploded six years ago. (Even USAID administrator Brian Atwood acknowledged that “The investment of over $2 billion of American foreign aid served no purpose.”) By some estimates, dictator Mobutu Sese Seko accumulated four billion dollars in personal assets, while running his country’s debt up to $12 billion. Yet, in 1996, U.N. Ambassador Bill Richardson made a pilgrimage to the newly minted Democratic Republic of Congo, promising to provide $50 million in aid to the new dictator, Laurent Kabila, despite the atrocities committed by his military.

In fact, virtually every nation in crisis, from Somalia to Liberia to Haiti to Burundi, has received billions from the West. Between 1970 and 1995, aid to Africa, excluding Nigeria and South Africa, averaged 12.3 percent of GDP, five times the peak share of Marshall Plan transfers to France and Germany.

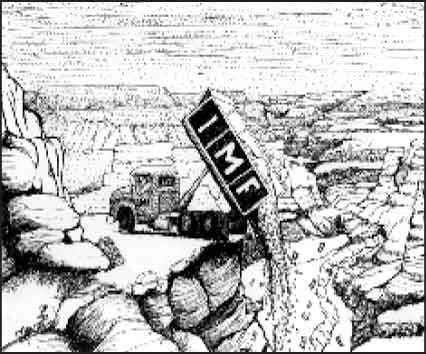

Even more staggering is the lack of any positive relationship between aid levels and economic growth. The U.N. Development Program reported in 1996 that 70 developing countries were poorer than they were in 1980; 43 were poorer than they were in 1970. Bryan Johnson of the Heritage Foundation points out that the vast majority of 66 states that had been borrowing from the World Bank for 25 years or more are as poor as they were before they took their first loan; one third are actually worse off. By my count, nearly one third of the world’s countries have been on IMF programs, without positive effect, for 10 to 20 years. Another 30 have been borrowing continually for more than 20 years.

Today, no one seriously disputes that markets are required for growth and that aid cannot work in their absence. Assistance, however, cannot buy market reforms. All that an increasingly beleaguered band of aid defenders can claim is that foreign assistance may be useful if extended to governments that have already adopted good economic policies.

Perhaps the best broad-based study of economic policies over the last two decades is Economic Freedom of the World (regularly updated). Economists James Gwartney, Robert Lawson, and Robert Block have created an index of 17 components to measure economic freedom as well as three alternative summary indexes. Two particularly important lessons emerge. First, economic policies matter; better policies yield higher rates of growth. Second, changes in economic policy affect growth rates. Studies by other analysts and organizations, including the World Bank, yield the same general conclusion. Though analysts may still argue about the exact role of government, statism is no longer a serious option.

For years, the late economist P.T. Bauer was almost alone in criticizing the efficacy of foreign aid. His views are now mainstream. Particularly impressive are studies by Peter Boone of the London School of Economics and Center for Economic Performance. Assessing the experiences of nearly 100 nations, he concluded that “Long-term aid is not a means to create growth.” In another study, he explained that “aid does not promote economic development for two reasons: Poverty is not caused by capital shortage, and it is not optimal for politicians to adjust distortionary policies when they receive aid flows.”

His conclusion is backed by World Bank economists Craig Burnside and David Dollar. Although they argue that assistance can work in a good policy environment, they note that

aid is fungible and tends to increase government spending proportionately, not just in the sector that donors think they are financing. That aid tends to increase government consumption, which in turn has no positive effect on growth, provides some insight into why aid is not promoting growth in the average recipient.

The Task Force on the United States and the Multilateral Development Banks, operated by the Center for Strategic and International Studies, was only slightly less pessimistic, reporting that “Substantial experience shows that development cannot be induced by resource transfers alone, but depends heavily on appropriate policies, functioning institutions, and cohesive societies.” A Congressional Budget Office study by Eric Labs reached a similar conclusion. The overall impact of aid, argues Labs, is at best “marginal”; assistance will, “in the best of circumstances . . . play only a modest role in promoting economic development and improving human welfare.”

There is evidence that aid actually discourages reform, by reducing the price of failure and the necessity of making politically painful policy changes. Indeed, in a recent issue of the National Interest, Bruce Bueno de Mesquita and Hilton Root report that, “On average, every dollar of per capita foreign aid improves an incumbent autocrat’s chance of surviving in office another year by about 4 percent.” All told, they figure that “foreign assistance may boost the survival prospects of poorly performing leaders by 30 percent or more.”

Advocates of foreign aid have responded by desperately concocting new justifications for old aid programs—the promotion of policy reform and good governance, for instance. But a host of critical internal audits raises serious doubts about the efficacy of the World Bank’s “adjustment lending.” Burnside and Dollar go even further: Despite the Bank’s commitment of tens of billions of dollars to such assistance, they conclude, “We find no systematic influence of aid on our index of fiscal, monetary, and trade policies.” The CSIS Task Force also had its doubts: “Experience has shown the limits of the [Multilateral Development Banks’] ability to exert leverage for policy changes.”

Of course, there are examples of aid recipients adopting reforms. It is hard to find any case, however, where there is convincing evidence that they did so because of aid. Take China, India, and the Soviet Union. All chose a reform path over the last two decades, and economic failure, not foreign aid, forced their decisions. Reform was their only option.

There is no reason to believe that President Bush’s Millennium Challenge Account will be more successful than the billions already spent. Countries must have the will to reform, and that cannot be purchased through the promise of more aid—especially if they can count on money from the IMF, the World Bank, and other OECD countries even if they reject the reforms advocated by one giver or another.

Success begets success. Today, private-capital flows account for 80 percent of net long-term financial transfers, a 30-percent increase over the past few decades. Net foreign direct investment increased tenfold during the 1990’s, to about $200 billion annually; total trade more than doubled, to $4.6 trillion.

Private capital flows most readily to other industrialized states. Gross private-capital flows as a percentage of GDP in 1999 generally exceeded 25 percent and ran up to 179.3 percent in Ireland. Although Panama hit 32.2 percent and a number of developing countries ranged around 10 percent, the average for low-income states was just 1.2 percent, compared to 4.9 percent for middle-income states and 29.2 percent for high-income ones. Foreign direct investment shows a similar relation.

Moreover, in the 1990’s, private-capital flows and foreign direct investment increases were greater in developing states. The fastest rises were in Latin America, sub-Saharan Africa, and East Asia—notably faster than in Europe. (The increase in South Asia was much slower; gross private-capital flows actually fell as a percentage of GDP in the Middle East and North Africa.) Overall, more than one third of foreign direct investment went to the developing world in the mid-1990’s, though that amount subsequently fell with the advent of the Russian and Asian economic crises.

Though foreign direct investment began the decade behind official development assistance, it was more than four times as high toward the end of the 1990’s. Other private flows—portfolio transfers and bank and trade-related lending—were more than twice as high as foreign aid. Indeed, over the 1990’s, aid ran $385.9 billion, while foreign direct investment was $1.013 trillion, and other private flows were $775.7 billion. (Remittances from workers overseas added another $450 billion in private transfers.) Although the various regional economic crises caused financial institutions to cut back their lending at de-cade’s end, foreign direct investment has largely continued apace.

Though increasingly important to poor countries, private investment has been concentrated in certain developing states. The top-ten recipients in the latter half of the 1990’s were China, Brazil, Mexico, Argentina, Malaysia, Poland, Chile, Indonesia, Thailand, and Russia. That concentration creates enormous risks when countries stumble—for instance, during the Asian economic crisis.

Shifting investment patterns, however, demonstrate the power of the private marketplace to reward good policies. Analysts from the Milken Institute argue that improving foreign-capital markets is a critical means of encouraging both growth and broad income distribution. Better financial systems reduce economic volatility, and “Access to capital is the key for mobilizing savings, reducing risk over time and across industries, monitoring managerial behavior and achieving efficient asset pricing” as well as nurturing “the development of a middle class, bridging existing income polarization.”

However well intentioned, those who extend aid to even the best of governments run the risk of reducing incentives to reform. Moving toward a free market is a continuous process; foreign infusions reduce the penalty for unwise economic policies.

Are there a few cases where well-administered aid might materially speed up the development process? Perhaps, but that is no justification for a program that has cost, in current dollars, over one trillion dollars since World War II. At the Monterey Summit, President Bush coupled his call for more money with a commitment to make aid more effective. But what administration has ever intended that assistance be ineffective?

In June 2002, African leaders met with U.N. Secretary General Kofi Annan to request more aid, promising to clean up their governments. But what African government ever claimed to be for worse governance, and what African government was ever disciplined by its neighbors for corruption and incompetence?

Harvard’s Jeffrey Sachs has called for “a better focused foreign aid program” that is “limited in duration” and accompanied by “a plan to phase it out.” But what agency reinvention or bureaucratic reorganization ever made a real difference?

Indeed, consider the IMF’s new strategy of bailing out countries in crisis. This, too, was supposed to be an entirely new, and limited, approach to aid. Charles Calomiris, a professor at Columbia Business School, argues, however, that bailouts result in three perverse effects:

(1) undesirable redistributions of wealth from taxpayers to politically influential oligarchs in developing economies; (2) the promotion of excessive risk taking and inefficient investment; and (3) the undermining of the natural process of deregulation and economic and political reform . . .

Mexico was supposed to be unique. Although that program was widely hailed a success, Calomiris argues otherwise. The Mexican government has never attempted to hold the original debtors responsible after purchasing $45 billion in bad debt from insolvent banks, causing “the transfer of billions of dollars from Mexican taxpayers collectively to the country’s wealthiest and most politically powerful enterprises and individuals. The economic result of these taxes is more than a pure transfer to the rich; taxation has also slowed recovery from the recession.” In addition, the Mexican banking system remains unreformed—a financial time bomb.

Indonesia negotiated an IMF bailout but resisted the IMF’s terms. A succession of weak governments has done virtually nothing to open the economy, despite billions of dollars in assistance and Jakarta’s promises to reform. Now, Indonesia is calling for more aid—for the War on Terrorism.

For decades, South Korea has received generous aid as well as enormous U.S. military subsidies. Although Seoul relied enough on market forces to generate some growth, cheap bank credit for the politically powerful created an artificial bubble ready to burst.

Calomiris reports that “Korea’s leadership has been much more cooperative [than Indonesia’s] with the IMF, but here appearances may be deceiving.” The banks continue to underwrite weak industrial conglomerates. “IMF aid is being channeled to the banks, which pass it along with impunity to the conglomerates that own them. Thus in Korea, the IMF has not even been able to prevent the immediate misuse of its funds, much less reform the long-term structure of the bank-industry relationships.”

All of these countries—and others, such as Argentina, Brazil, and Turkey—are in trouble because of their own policies. Politicized banks are often at the root of such economic disasters. Only after the bubbles burst are the countries forced to address the underlying issues. Economic failure, not loans from the IMF and the United States, forces governments to act.

Borrowers in crisis are likely to do only the minimum necessary to receive aid. Left to their own devices, they would have to adopt all of the reforms necessary to recondition their econ-omies and reassure foreign investors, who tend to be more careful with their own cash than international-aid bureaucrats are with tax monies from industrialized states.

Now that Washington has intervened again and again, what country cannot expect help? Every case is judged to be exceptional, warranting intervention. Perhaps the only instance in which the IMF held back was that of Argentina, which defaulted on her massive debt in December 2001.

This proclivity to intervene creates what economists call “moral hazard.” The expectation of a subsidy encourages people to behave irresponsibly, as did many owners of federally insured savings-and-loans. Economist Allan Meltzer warns that “banks and financial institutions can now act safe in the knowledge that the IMF will provide a safety net to protect them from some, or even most, of their losses.” This is a form of corporate welfare conducted by government institutions that act as Robin Hood in reverse.

Despite the best efforts of many dedicated professionals, foreign aid has failed. Whereas advocates once claimed that international transfers would move developing states into the industrial age, an increasing number of supporters now acknowledge that it might work only when countries have already adopted market reforms. In those cases, however, aid is not needed. After a half-century of failure, it is time to stop wasting the taxpayers’ money and to look for new strategies to ease the agony that afflicts so many of the world’s people.

Increased private trade and investment flows are the best way for the West to promote prosperity, and negotiations between individual debtors and lenders are the best response to financial failure. The steady growth of private economic power vis-à-vis poor, unsophisticated governments is not without adverse consequences, especially for more traditional and conservative societies. But it is a better alternative to rapacious collectivist regimes presiding over petty autocracies that hold their people in financial poverty and political bondage—and to Washington, Brussels, and Tokyo taxing their own people to fund failure.

Leave a Reply