Warfare and hunting are two closely related and most ancient human pursuits—significantly older than literacy. Violence is immanent to man. The use of force in relations between communities has been present in all epochs, civilizations, and geographic spaces. It remains indifferent to the drivel of “democratic peace” theorists.

In the context of world history, the conflict in Ukraine is significant but not unique. The claim that it shattered decades of post-World War II peace in Europe is untrue. NATO did that—led by the Bill Clinton administration when it attacked Serbia in 1999 in order to make Kosovo safe for Madeleine Albright’s and Richard Holbrooke’s Albanian terrorist protégés.

The assertion that “Putin’s war” is an unprecedented act of unprovoked aggression by a major power is equally untrue. The neoconservative joint criminal conspiracy, which led to the U.S. aggression against Iraq in 2003, was far more egregious in attempted justification and—thus far—tenfold more bloody in consequences.

What makes this conflict different is the palpable sense—on both sides of the central divide, and also in various uncommitted quarters—that it will result in a major and lasting rearrangement of the geopolitical map of the world.

This shift has already happened along the western rimland of Eurasia, with the European Union morphing from a potential actor in its own right into an American bridgehead composed of nominally sovereign countries denuded of substantial decision-making powers. Their supine acceptance of sanctions against Russia—which are destroying their own economies and tearing apart their social structures, especially in Germany—is a political phenomenon with no precedent in history.

Vladimir Putin has embarked on an undertaking that he is unable to control but that he cannot afford to lose. It is unclear what would satisfy his definition of “victory” now, or six months from now. What does seem clear is that the Ukrainian campaign is not just the fight to retain strategic depth along Russia’s vulnerable southwestern flank; it is also the struggle to retain its status as a great power. That status was obtained at considerable cost 300 years ago by Peter the Great; it was cemented when Russia broke the back of Napoleon’s Grande Armée a century later; and it has been challenged ever since: in Crimea in the 1850s, at the Congress of Berlin in 1878, during the Great War, during the life-or-death struggle of World War II, and during the decade of weakness in the 1990s.

The current war could have been avoided had Russia been recognized by its Western “partners” as a legitimate power with legitimate security interests in its near-abroad. That was not to be. For reasons yet to be fully adduced, after the Maidan coup in 2014, the United States, with enthusiastic support from Britain and Poland, decided to weaponize Ukraine as an anti-Russia. Russian warnings were ignored and Russia’s chronic sense of insecurity was rekindled. In the end, Putin’s hand was forced.

It is to Putin’s lasting discredit, however, that he allowed himself to be goaded into a no-win situation in the first place. A world-class statesman would have avoided that quandary. As I have written elsewhere, I think that Putin should have intervened in Ukraine earlier, in February 2014, immediately after the Maidan coup, and certainly by May of that year at the latest, after the massacre of anti-Maidan demonstrators in Odessa.

In the seventh month of the “special military operation,” Russia aspires to unite the Rest against the West, and the potential is there. NATO plus Japan and Australia account for 1 billion souls (and decreasing). The leaders of the remaining 7 billion overwhelmingly reject the U.S./EU/NATO “rules-based international order” as the hegemonistic fraud that it is. The majority quietly roots for Russia, not because they like Russia, but because they dislike American hegemony. Russia’s failure to achieve a decisive breakthrough on the Ukrainian battlefield, however, is undermining its credibility. The longer the operational stalemate continues, the weaker Russia’s position will become, vis-à-vis both its Western adversaries and its putative Chinese allies.

As America’s only truly global opponent, China is ostensibly supportive of Moscow but careful not to overexpose itself. Xi Jinping’s stated objective is for the People’s Republic—reunited with Taiwan—to reach the status of a major global power by the centennial of Mao’s victorious revolution, in 2049, consigning “the century of humiliation” to the dustbin of history. China needs Russia—preferably as a client rather than an equal partner—but holds a quiet reserve about Putin’s action in Ukraine. The reason is clear: China is not yet ready for an all-out confrontation with the United States, as was apparent during the mini-crisis caused by Nancy Pelosi’s visit to Taiwan in August.

The United States is balancing between the desire to fight Russia to the last Ukrainian and the need to prevent escalation, which would entail direct military engagement. At the moment, the Biden administration does not have a plan B, which is dangerous, especially in the case of a sudden Russian breakthrough. While it is unlikely that sanctions will undermine Russian resolve, they do have the potential to undermine Western unity when their effect on the wealth, social cohesion, and institutional stability of Western Europe becomes fully apparent.

Apart from geopolitical considerations in the narrow sense, it is also possible that the realignment of global forces resulting from the war in Ukraine may undermine the status of the U.S. dollar as the world’s reserve currency. That status was first achieved in the post-World War II era, when America held a unique position as the world’s dominant economic, military, diplomatic, and regulatory power. The dollar became a formidable weapon of geopolitical primacy. It is still the main currency of global trade in goods, services, energy, and raw materials. Well over half of the world’s foreign-exchange reserves continues to be denominated in dollars. Any sanction imposed by Washington is therefore a potent weapon.

To this challenge, the adversarial powers have responded by seeking de-dollarization. Since 2018, Russia has openly aimed to “dump the dollar” in its foreign trade, especially in oil. Between 2013 and 2020, the Central Bank of Russia more than halved its reserves in dollars, and since 2018, it has embarked on a diversification policy, buying large quantities of gold, euros, and renminbi. Over the past two years, Russia has also radically reduced its trove of U.S. Treasury bonds and completely removed dollar assets from its sovereign wealth fund.

More importantly, China and Russia have greatly reduced their dollar-denominated foreign trade. In 2019, Moscow and Beijing pledged to conduct at least 50 percent of their trade in their respective currencies. Currency swaps between Russian and Chinese central banks have helped Moscow circumvent the U.S. sanctions, facilitating bilateral trade and investment.

The Russian government has made similar agreements with other countries—notably India, Turkey, and the other members of the Eurasian Economic Union—to prioritize the use of their national currencies in bilateral trade. At the end of 2020, just 10 percent of Russian exports to BRICS countries (Brazil, Russia, India, China, and South Africa) were traded in dollars, compared to 95 percent in 2013.

This is especially significant because India is an emerging economy of 1.4 billion people, which the United States would dearly like to see in its chain of anti-Chinese containment. Recently, India broke away from the Western sanction regime through a new rupee-ruble agreement with Russia. Delhi is the world’s leading buyer of Russian weapons, and in 2021, the two countries abandoned the dollar in all defense-related transactions. Both Russia and China are developing non-dollar-based interbank payment systems as an alternative to SWIFT.

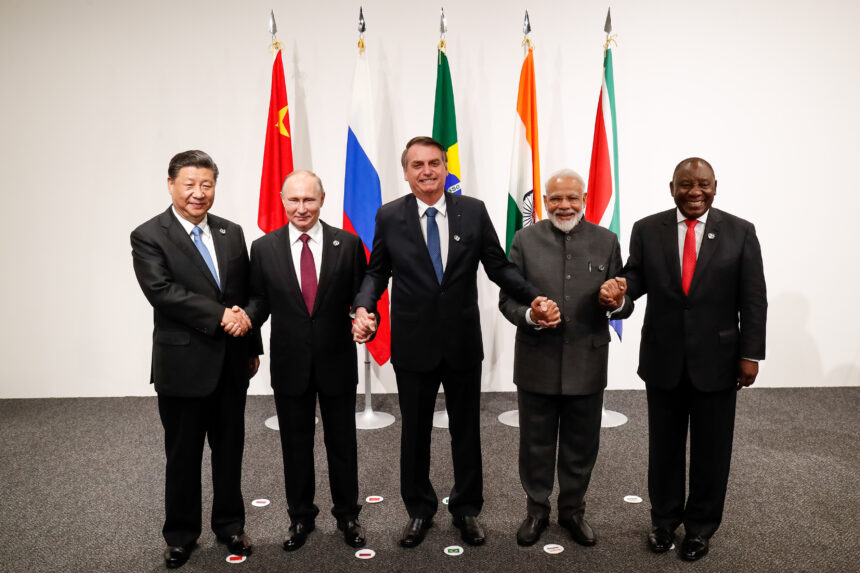

of the New Development Bank,

also known as the BRICS

Development Bank, jointly

established by Brazil, Russia,

India, China, and South Africa

(Wikimedia Commons /

CC BY 2.0)

De-dollarization reflects diversification of geoeconomic hubs, of which the most important is BRICS. Developed in order to redirect the world from unipolar Western domination to a more diversified multipolar order, BRICS accounts for over 40 percent of the global population and about a quarter of the world’s gross domestic product, according to World Bank data from 2019. The new development bank created by BRICS countries raises funds in local currencies. Over the past two decades, the world reserves denominated in dollars have fallen from over 70 percent to under 60 percent. This is not due to a change in exchange rates and interest rates. It is the result of the deliberate diversification strategies pursued by governments and central banks. Many of them, including non-BRICS members, are contracting debts in local currency in order to make themselves less vulnerable vis-à-vis the U.S. dollar.

At the same time, however, China maintains extensive commercial ties with the United States. Beijing retains more than a half of its foreign exchange reserves in dollars and conducts less than a quarter of its foreign trade in yuan. America remains China’s main export market, despite trade wars and COVID-related disruptions of supply chains. Beijing is pursuing a steady erosion of the dollar also by developing a digital currency—an electronic yuan under its sovereign control—to help circumvent the dollar-centric system, but the process is slow.

The strategists in Washington hope that the dynamics driving the attack on the Bretton Woods system and the erosion of the dollar-centered order will not force a collapse of the global edifice any time soon. But ironically, America may have done more than any of its adversaries to undermine the global financial system by resorting to the freezing of bank reserves—Russian reserves in particular—which amounted to an arbitrary seizing of wealth and a violation of the sanctity of property rights. Simultaneously, the cost of America’s foreign interventions and social turmoil at home lead to continued federal overspending. The ever-growing mountains of fiat money reduce the confidence of even those countries that are not at political odds with the U.S.

It is hard to imagine that a decade from now the U.S. dollar will be able to retain its position as the world’s reserve currency. It is equally hard to imagine that the striving for full-spectrum global dominance can continue if the United States government loses the ability to print money by creating debt (but not inflation) and letting the rest of the world absorb the excess money supply.

The world is between orders. A new configuration is certain to emerge from the current crisis. Its contours are obscure, but its three key elements—the West (North America with its European dependencies), Eurasia (China and Russia), and the Indo-Pacific Rimland (with India as its pivot)—are certain to be the pillars of any new order. It cannot be otherwise because the variables of human will and power operate within a permanent spatial milieu, in which and through which every human society and international system must function.

It is in the American interest for informed citizens to acquire awareness of the spatial dimension when considering power relations between states and nations. That vision is the prerequisite to understanding and developing a critique of the current U.S. administration’s de-territorialized policy of full-spectrum global dominance. That policy is irrational, dangerous, and self-defeating.

In the emerging new global order, America would do well to effect a “strategic pause” in order to take stock of the present geopolitical state of play, reconsider its priorities, and develop clear policies on the basis of their likely costs and benefits. That this sensible, modest approach will not likely be undertaken is unfortunate both for America and for the world.

Leave a Reply