From the March 1996 issue of Chronicles.

In accepting the Democratic nomination for the presidency in 1908, this century’s greatest populist warned: “How can the people hope to rule if they are not able to learn, until after the election, what the predatory interests are doing?” The man was, of course, William Jennings Bryan, and he offered a “complete and effective” solution to the financing of political campaigns: a ban on contributions from corporations, a cap of $10,000 on individual contributions, and public disclosure of all contributions prior to an election.

Current law falls well short of Mr. Bryan’s prescription, and the issue still commands substantial populist support, not least among Ross Perot’s followers. Yet financial abuses in political campaigns predate the Republic itself, at least by the yardstick of current standards. Had Common Cause, the clean campaign lobby, been around at the time, they surely would have admonished George Washington about his 1758 campaign for a seat in the Virginia House of Burgesses. At an election day event, Washington served up 46 gallons of beer, 34 gallons of wine, 28 gallons of rum, 50 gallons of rum punch, and two gallons of cider royal. Considering there were just 391 voters in his district, his expenditure per voter was at least comparable to Michael Huffington’s nearly $30 million campaign for the Senate in 1994. Nor would Common Cause have been pleased with Abraham Lincoln’s secret $400 purchase in 1860 of a German-American newspaper to ensure favorable reporting of the Republican Party both in English and in German.

The brief history of campaign finance reform that follows shows how legislative action has attempted—and largely failed—to address the problems arising from the financing of political campaigns. It is a history that highlights the difficulty in legislating politically acceptable solutions that do not jeopardize our constitutional guarantees of free speech.

Public attitudes toward political campaigns have clearly changed since the Republic’s founding. During the nation’s early years, the economy was primarily agrarian, and there were no large corporations capable of corrupting the political process. Moreover, the minuscule fraction of the nation’s resources controlled by Congress did not enable politicians to channel wealth to favored individuals and businesses. Congress, during this period, also kept within the bounds of the Constitution—especially a narrowly interpreted Commerce Clause, and the Ninth and Tenth Amendments, which grant all rights not enumerated in the Constitution to the states and to the people. Finally, because Congress was convened for only a few months out of the year, members had less time to make mischief.

Not only has the scope of government increased over the years, but the ambitions and tenure of legislators have changed as well. In the early years of the Republic, those holding national office were primarily merchants and gentleman farmers. They came to serve their nation for a few years and then returned to private life. Not only did they rely on their own financial resources for their political campaigns, but they also were expected to bear many of the expenses associated with holding office. This burden could be substantial. Thomas Jefferson, who inherited extensive landholdings, was nearly insolvent by the end of his second term.

By the early 19th century, the professional politician had emerged. Not men of wealth, they sought outside resources to fund their campaigns. This need for recurring financial support provided the foundation for political parties. This, in turn, led to the development of a system of political spoils. Under this system, a large number of federal patronage positions were established, and the beneficiaries of these positions were required to “donate” a percentage of their wages to the party in power. These mandatory contributions were outlawed in 1867.

Although the growth of the railroads, the banks, and the oil companies in the early 1800’s produced wealthy individuals with national political ties, these titans were relatively few, and their political dealings were usually kept well-concealed from the general public. If reform was needed to curtail these influences during the nation’s first century, the public was not generally aware of it.

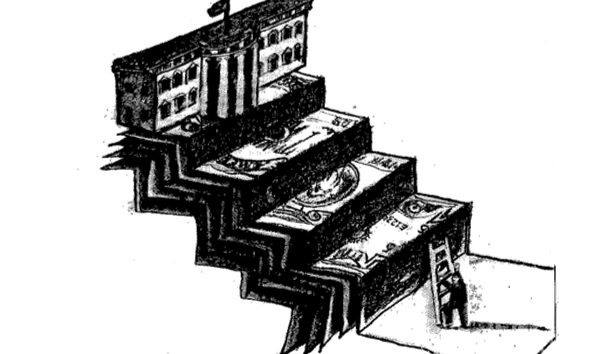

At the beginning of the 20th century, commercial interests had become increasingly important to the nation’s economy, and businessmen sought access to national officeholders. Because the number of businessmen seeking access grew much faster than the number of officeholders, access became more difficult to acquire. As in most other markets where price becomes the primary mechanism for allocating scarce goods, political contributions naturally emerged as the way to allocate access within the legislative marketplace.

The second cause of changing campaign standards is a result of the expanding scope of the federal government. Although federal budgets did not begin to balloon until the onset of the New Deal, legislators had the power to confer great wealth on corporations and their owners through the legislative process.

Until after the 1904 election of Theodore Roosevelt, the public was largely ignorant of the magnitude of corporate giving to national candidates. At hearings held by a special committee formed by the New York state legislature after the election, it was disclosed that both parties had solicited and received large contributions from major corporations and financial organizations. A public outcry ensued, causing President Roosevelt to request in December 1905 that all campaign contributions from corporations and banks be outlawed. After considerable maneuvering, a bill to this effect was passed by Congress in 1907, which Roosevelt signed into law. Meanwhile, public revelation of these business contributions had dampened any inclination the administration might have had to show favor to its major contributors. In the words of one contributor, steel magnate Henry C. Frick, partner of Andrew Carnegie, “Roosevelt got down on his knees to us. We bought the son of a bitch and he did not stay bought.”

In 1910, legislation was enacted that required organizations operating in two or more states to report their political contributions. Reporting requirements were also imposed on individuals. But a provision for pre-election reporting was deleted prior to passage, thereby denying voters knowledge of questionable activities until after an election. Thus, voters would be forced to wait until the next election to exact retribution.

Two additional laws also affected campaign financing. When the 16th Amendment instituted the national income tax in 1915, it opened a floodgate of opportunity for congressmen to use and abuse tax laws to stimulate contributions from affected business interests. And as campaign costs escalated, so, it seems, did the number of businesses affected by changes in the tax laws. The other law, passed in 1911, clamped down on political committees influencing senatorial candidates. This legislation also imposed reporting requirements both on political organizations and the individual candidates for congressional office, and it placed a ceiling on the amount candidates could spend in primaries and elections. Whether Congress in fact had the power to regulate primaries was a matter of intense debate—the Constitution makes no direct mention of primaries—especially in the South, where the outcome of the primary virtually determined the outcome. The Supreme Court declined to resolve this issue in 1921, in Newberry v. U.S.

The Federal Corrupt Practices Act of 1925, the next major reform of campaign laws, was propelled through Congress in reaction to the Teapot Dome scandal, in which President Warren G. Harding’s Interior Secretary had received kickbacks from a company whose contributions to the GOP had helped retire the party’s campaign debt. The Corrupt Practices Act overhauled existing law, but primaries were removed from its scope. A provision was added to require disclosure of contributions not made during an election year—a loophole that had facilitated the Teapot Dome scandal.

Still, federal election law was easy to sidestep. Limitations on campaign expenditures applied only to spending made with the “knowledge of consent” of the candidate. In addition, political committees operating solely within a single state escaped the grasp of the law. It was thus easy to shield candidates from knowing about campaign expenditures, or to devise ways to channel contributions to single-state committees.

The limitations on contributions were circumvented by giving the maximum amount to each of numerous committees working on behalf of a favored candidate, and corporations would legalize their large contributions by distributing them first as “bonuses” to their managers. Labor unions could collect contributions, other than dues, from their members for candidates and could deploy treasury funds for get-out-the-vote activities. Finally, existing law included no provisions for reviewing or publishing disclosure reports to correct errors or omissions, thereby diminishing the effectiveness of disclosure. To make matters worse, though it remained easy to circumvent existing campaign laws, even the punishable offenses that did come to light were studiously overlooked.

Apart from the 1939 Hatch Act, which prohibited overt political activity by federal employees, significant campaign reform had to wait until 1971. In that year, the Federal Election Campaign Act was passed to address the weakness of existing campaign reform laws. The FECA and its 1974 amendments represented the most comprehensive effort at campaign finance reform and remains the basis for current law.

The 1971 act imposed limitations on individual contributions. All political committees active in any federal campaign, including those operating within a single state and receiving or spending in excess of $1,000, were subject to reporting requirements. Donations above $100 to individual candidates and to committees had to be disclosed. Overall limitations also were imposed on each candidate’s media expenditures. These limitations applied separately to primary and general elections.

To encourage more widespread public participation in election campaigns. Congress also enacted the Revenue Act of 1971. This law gave taxpayers the option of earmarking $1 of their federal income taxes for the public funding of presidential elections. Under this act, presidential candidates who met minimum qualifications and who agreed to observe overall campaign expenditure limits would receive matching funds.

The 1974 amendments to FECA followed the Watergate revelations about campaign law abuses. These amendments substantially enhanced the 1971 act by reinstating overall ceilings on each candidate’s campaign expenditures, by imposing strict new contribution regulations, and by strengthening disclosure requirements. The amendments also encouraged contributions from political action committees (PACs) by repealing the Hatch Act provisions prohibiting unions and corporations with federal contracts from creating PACs.

These strict provisions brought together opponents from both ends of the political spectrum, including Senator James L. Buckley, elected as a Conservative Party candidate from New York, Democratic Senator Eugene J. McCarthy, and the New- York Civil Liberties Union. Their challenge reached the Supreme Court, and in 1976, in Buckley v. Valeo, the Court ruled large sections of the law unconstitutional. While validating the ceilings on contributions to candidates and political committees and the disclosure requirements, the Court overturned on First Amendment grounds the overall campaign spending limits, the spending limits imposed on a candidate’s personal funds, and all limits on contributions to and spending by individuals and organizations who act independently of candidates. While Buckley prevented the shredding of the First Amendment, it left campaign finance reform much weakened. Congress responded to Buckley by passing amendments in 1976, but these did little to revitalize the reform laws.

More recent attempts at campaign finance reform have been unsuccessful. Indeed, this is the most difficult legislation to enact because it strikes at the very heart of partisan politics. Overwhelming any arguments on the merits of reform is the lawmakers’ fear of giving any challenger or the opposite party a political advantage. Because existing campaign finance laws strongly favor incumbents, it usually takes a major political scandal to cause lawmakers to fear their constituents enough to enact meaningful campaign reform.

The chief problem associated with the unregulated flow of money in political campaigns is how such funds could influence (or appear to influence) legislation. But there are additional problems as well. Tax bills and other legislation may be altered not only in response to contributions, but also to stimulate contributions. Legislators have a clear understanding that the power to tax is the power to destroy.

There is also the issue of access. While special interests vigorously deny that their contributions give them undue influence over legislators, they do acknowledge that they receive special access to the legislative process. However, this, too, is not without ethical difficulty. Most Americans would contend that the political system should be equally accessible to all. While this may not be possible in practice, the common view is that money should not be the key to a congressman’s door.

Another problem concerns the advantages of incumbency. These advantages include the franking privilege, name recognition, free publicity from the media, and the opportunity to campaign while traveling on official business. But perhaps the greatest advantage is the ability of incumbents—and especially members of the party in power—to attract campaign contributions from special interests, while their challengers are left to beg for the crumbs. Finally, many people view as excessive the total resources expended on electing people to national office.

Most proposals to reform campaign financing draw on the following concepts; limitations on the size of political contributions, ceilings on campaign expenditures, public disclosure, and public funding. The first of these, dollar limitations on contributions, is aimed at reducing the potential for buying influence or access. Ceilings on campaign expenditures, if sufficiently stringent, are designed to limit the necessity of raising large amounts of money, but they also provide another wav to monitor campaign receipts, since receipts must equal expenditures plus campaign debt. Requiring public disclosure of contributions relies on the theory that candidates avoid transactions that cannot stand public scrutiny. Finally, public funding is designed to replace private funding and the various problems associated with it.

But each of these elements has its problems. The First Amendment prevents any limitation on contributions to organizations that are not directly controlled by the candidate. Also, funding used for “nonpartisan” activities, such as get-out-the-vote drives, is usually exempt; thus, loads of “soft money” are often available to partisan groups for getting out the vote of their people. The First Amendment also poses an effective barrier to legislated ceilings on campaign expenditures, unless the ceilings are voluntary, in which case they must be made sufficiently attractive by inducing candidates with such things as matching public funds, as in our presidential elections. However, the popularity of public funding appears to be waning. It seems unlikely that the current funding mechanism—the income tax checkoff—could provide sufficient public funds for both presidential and congressional campaigns. Moreover, even with matching funds, candidates still need to solicit contributions from individuals and businesses. Finally, public disclosure, while apparently effective in preventing the worst abuses, has not been a sufficiently powerful deterrent to eliminate at least the appearance of buying influence.

A recent innovation in campaign finance reform is a proposal by Representative Linda Smith (R-Washington) to require a large proportion of a candidate’s campaign funds to originate within the candidate’s district. This could restrict the ability of corporations and other special interests operating outside of the candidate’s district from influencing the process. Of particular significance is the potential of this provision to limit sharply the flow of money to the powerful chairmen of major congressional committees. However, it is not clear whether this proposal could withstand First Amendment scrutiny.

I would like to offer an alternative solution that, ironically, is based on nondisclosure of contributions and allows unlimited campaign contributions and unlimited expenditures. Its potential for success rests on a single principle and on two assumptions. The principle is this: If officeholders cannot identify their contributors, then their legislative actions cannot he influenced by them. The device for putting this principle into effect is a financial institution that receives campaign contributions on behalf of candidates, but which erects a firewall between the contributions and the individual campaign expenditure accounts, which the institution creates for the candidates. This firewall is constructed to prevent candidates from knowing the names o{ their contributors as well as the individual amounts of the contributions.

Two assumptions must hold for this reform measure to be effective. The first is that voters will reject candidates who do not receive all of their campaign contributions from our special financial institution, which we’ll simply call the Bank; and the second is that candidates will deem it in their interest to receive all of their campaign contributions through the Bank. If the first assumption is valid, the second is likely to be valid as well.

The primary function of the Bank is to accept campaign contributions on behalf of specific candidates and to credit their campaign accounts for the amount of the contribution. The firewall is similar to a blind trust and is constructed so that for any single contribution no person, other than the contributor, knows with certainty both the name of the contributor and the name of the recipient.

One way of producing the firewall is with a special “contribution kit.” The kit would consist of a pair of attached envelopes. Each of the two envelopes would have imprinted on the outside the same unique bar-coded serial number. Also printed on the outside of each envelope would be the letter “R” (for Republican). “D” (for Democrat), or “O” (for other).

The first envelope would have an outside flap on which the contributor would record only the name of the recipient; in particular, neither the contributor’s name nor the amount of the contribution would be recorded. (This envelope could be constructed similarly to those supplied by credit card companies, which use the envelope flap to sell merchandise.) After filling in the recipient’s name, the contributor would seal the form inside the envelope.

In the second envelope, the contributor would enclose a check in the amount of the contribution, but made out to the Bank. The contributor’s name could appear on the check, or on a separate form. This envelope would then be sealed, and would contain nothing that could identify the recipient. Indeed, a check received with the recipient’s name on it would be returned to the contributor.

The envelopes, still attached to each other, would be mailed or otherwise delivered to the Bank. Upon arrival, each envelope pair would be separated by a Bank employee. The serial number would be scanned into a computer. Then the envelope containing the donation would be opened and the amount of the contribution entered into the computer. Finally, a receipt would be prepared and mailed to the contributor. At the end of the day, the contribution would be deposited into the Bank’s general account.

The same employee would route the second sealed envelope, containing the name of the recipient, to Section R, D, or O, depending on the letter stamped on the outside of the envelope. Envelopes route to Section R, for example, would be opened by a different bank employee, who would scan the envelope’s serial number into a computer and enter the recipients name. A party functionary could be present to witness this operation to ensure that the unknown contribution from the unknown contributor is credited to the correct candidate. At the end of the day, after checking deposits and account credits had been reconciled, all envelopes would be shredded, and the forms themselves could be shredded, or stored in a secure area.

At this point in the process, besides the contributor, only the computer “knows” the name of the recipient in addition to the name of the contributor or the dollar amount of his contribution. The contributor is able to prove only that he has made a given contribution to the Bank—he has a receipt to this effect. He cannot prove lie made a given contribution to any particular candidate or party. Of course, he can claim to have made a contribution to a specific candidate, but so could anyone else with a receipt from the Bank.

Indeed, specious claims should be encouraged. Legitimate contributors may well attempt to inform the recipients of their contributions. However, the less certain the recipient can be of the contributor’s claim, the less likely he is to be influenced by it. Consequently, an abundance of specious claims will have the effect of debasing all claims generally.

A few housekeeping rules are needed to minimize cheating. To prevent contributors from “marking” their contributions by donating an “odd” amount (such as $16,666.66), contributions would be accepted only in five-dollar multiples. More importantly, to prevent identification because a contribution is unusually large, a provision could be imposed whereby no single contribution could comprise more than, say, 20 percent of a candidate’s total receipts in any given accounting period. Contributions in excess of 20 percent of total receipts would be carried over automatically into the next accounting period, and the 20 percent restriction again applied.

At the end of each accounting period, each candidate would receive a report showing his account balance, but this report, which would be publicly available, would list neither the names of the donors nor the amounts of individual contributions. Candidates would be free to spend all positive balances in their accounts on their campaigns.

To deter a contributor from simply handing to the candidate the attached envelopes with a check enclosed—for the candidate himself to seal and mail—we would modify the process for contributions exceeding, say, $100. (It is doubtful that a politician can be “bought” for less than $100.) For these larger contributions, rather than specifying the name of the recipient in the second envelope, the contributor would report his own name, telephone number, and perhaps an identifying code word. An employee of the Bank would then telephone the contributor to obtain the recipient’s name. An electronic menu system would allow the contributor to use his telephone to key in the name of the recipient after entering his code word.

Is the firewall totally effective? No. Just as current campaign finance law as well as proposed laws could not prevent an individual from slipping a suitcase full of cash to a candidate, the current proposal also could not prevent this. While I have indicated that no new legislation would be needed to implement this proposal, legislation to require the reporting of all campaign expenditures could expose those cases in which campaign expenditures exceeded a candidate’s total receipts from the Bank, plus the campaign’s accounts payable, plus expenditures from the candidate’s personal resources. Such cases would strongly suggest that the candidate had received contributions that circumvented the Bank, and the threat of public disclosure of this information by die Bank to voters would be a deterrent.

Lastly, I wonder whether there remains any reason for making a contribution directly to the candidate rather than through the Bank. The reasons for making such contributions are: to influence legislation, to gain privileged access to the officeholder, to gain privileged access to information, to thank a legislator for supporting or promoting a particular piece of legislation, and to support a candidate whose past, present, or future actions or beliefs are deemed desirable. The first three reasons have as their aim increasing the likelihood of receiving something of value in exchange for the contribution. Contributions motivated by these three reasons are therefore to be minimized. Contributions for the last two reasons can be accomplished just as effectively through the Bank, and by going through the Bank the contributions are effectively cleansed.

Civil libertarians should be heartened by this proposal because it impinges in no way on the First Amendment. Individuals and businesses become free to contribute unlimited amounts of money to support candidates of their choosing as long as their contributions are tunneled through the Bank.

Could such a proposal be implemented? Quite easily, it would seem. All it would take is a financial institution willing to set up the machinery for the Bank, and political candidates who believe they can gain a competitive edge on their rival candidates by renouncing all direct campaign contributions. The marketplace would then assert its judgment.

This proposal offers a free-market solution to the problems raised by campaign contributions and political influence. The Federal Elections Commission could be abolished, or reemerge as a mere shadow of its former self, enforcing only the reporting requirements on campaign expenditures. The campaign finance reform laws now on the books could be scrapped, along with the existing machinery for collecting and distributing funds to presidential candidates. Campaign restrictions on the candidates themselves would certainly become less onerous.

Finally, I would expect an increase in the proportion of total campaign contributions received by challengers versus incumbents, because contributions would now be driven largely by preferences for candidates, rather than by access to the system. And because influence, privileged access, and privileged information would no longer be for sale, I would expect a reduction in overall campaign contributions and campaign spending, a decrease in the proportion of total campaign contributions received by the party in control of the House and the Senate—and especially among committee chairmen—and a reduction in the manipulation of legislation, especially tax legislation, for the purpose of eliciting contributions.

Leave a Reply