The Madison Forum was founded in 1993 by Missouri State Senator Walt Mueller and me for three reasons. First, we wanted to respond to the Supreme Court’s claim in Missouri v. Jenkins (1990) that the federal judiciary’ has the authority to levy or increase taxes. We believe this constitutionally baseless assertion by the Court poses a direct threat to our democracy.

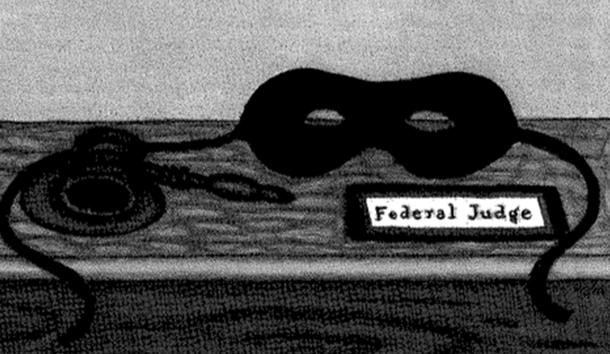

The second reason concerned the federal judiciary’s “attitude problem.” This “attitude,” reflected in the Court’s decision in Jenkins, was made clear to us in a 1994 meeting we had with Federal District Judge Russell G. Clark, who oversaw the Jenkins case for over ten years and levied the controversial tax which nearly doubled the property taxes in Kansas City, Missouri. Clark had no patience with the argument that the authority to tax is vested in the legislative branch alone, saying that if the Supreme Court declares the judiciary’s right to tax, then this power is constitutional, period. When I said that he would have us believe that the Court could declare a rainy day to be sunny, Clark replied: “It may be raining outside, but if the Court says the sun is shining, then the sun is shining. What you believe makes no difference.”

The third reason has to do with Congress. In Federalist 33, Hamilton stated: “What is the power of laying and collecting taxes, but a legislative power?” And in Federalist 81, he pointed out that it was an impeachable offense for the judiciary” to usurp a legislative power. But Congress, being fully cognizant of the Court’s decision in Jenkins, has neglected or refused to address this usurpation and exercise of what has been by custom, history, and tradition a legislative function.

In his defense of McCulloch v. Maryland, Chief Justice John Marshall observed that the exercise of the judicial power to decide all questions “arising under the Constitution and laws” of the United States “cannot be the assertion of a right to change that instrument.” Former Chief Justice of Missouri Robert T. Donnelly narrowed that perspective further when he stated: “If in fact, the United States Supreme Court is exercising powers without the consent of the governed—the people—then the rights it purports to secure in their name are counterfeit—its benevolence a fraud.”

We contend that in Jenkins the Court committed what amounts to judicial fraud by declaring that the District Court did “satisfy equitable and constitutional principles governing the District Court’s power.” This usurpation of power by the judiciary is even more staggering when one remembers that it took the 16th Amendment to the Constitution to empower even the legislative branch to tax the people.

The Madison Forum has therefore asked each .state to petition Congress for an amendment to the Constitution which would check this usurpation of power by the federal judiciary. To date, the following states have sent Congress such a request: Missouri, Tennessee, New York, Colorado, Louisiana, Alaska, Massachusetts, Arizona, South Dakota, Nevada, and Michigan. In addition, the American Legislative Exchange Council adopted a model resolution which will be forwarded to the states this year.

Proposing a constitutional amendment may seem like putting the cart before the horse. But consider the following and then decide whether our solution to ending judicial taxation is, under the circumstances, reasonable.

Following the Court’s 1990 riding in Jenkins, Senator John Danforth of Missouri actually proposed our idea of amending the Constitution for the purposes discussed above. Congress held hearings on the idea, and several members objected. They indicated a preference for exercising Congress’s power, under Article III of the Constitution, to end the taxing authority of the federal judiciary by statute. There was a lot of talk, but no legislation materialized.

In May 1992, I traveled to Washington to determine the seriousness of Congress’s interest in this issue. Congressman Henry Hyde, a member of the House Judiciary Committee, was quite candid with me: “While I am sympathetic to your concern, on this issue, quite frankly. Congress just doesn’t give a damn.” He was right. It turns out that when the budgets of the states are jeopardized by unfunded judicial mandates. Congress could not care less. But when Congress’s fiscal turf is faced with such a threat, well, that is another story.

In 1994, while a balanced budget amendment was still in the planning stage. Senator John Danforth cautioned his colleagues: “A balanced budget amendment would be a disaster if federal courts were able to increase taxes or cut spending.” The following year, during debate on the balanced budget amendment, members of Congress expressed concern that the amendment might allow the judicial branch to inject itself into the federal budget process. Senator Paul Simon stated: “I don’t think that will happen in the immediate future. I’m not sure but that 30 or 40 years from now the Court might not be in a position to order Congress to comply.” Others, including Senator Robert Byrd, former Senator Tom Eagleton, and syndicated columnist James Kilpatrick expressed similar concerns, and Senator Sam Nunn admonished those who doubted the judiciary’s interest in expanding its power: “If you don’t think this is a danger, look at the Missouri case.”

Last year, Republican Congressman Jim Talent of Missouri introduced House Joint Resolution 167, which proposed “an amendment to the Constitution of the United States to limit the judicial power of the United States.” He could find only a handful of cosponsors. Senators Strom Thurmond and Bob Dole tried, with Senate Bill 17908, merely to preclude “the lower Federal courts from issuing any order or decree requiring imposition of ‘any new tax or to increase any existing tax or tax rate.'” But this bill only addressed new taxes while letting current judicial tax orders stand. We believe judicial levying of any tax is unconstitutional. Leaving current judicial tax orders intact gives credibility to the Court’s assertion that it acted constitutionally. Others members of Congress countered with legislation —such as House Resolution 3100 and Senate Bill 1817 — that would legitimize the judiciary’s authority to tax. Both bills allow the federal courts to encroach on the legislative branch’s traditional and constitutionally mandated turf; both permit the judicial branch to add force and will to their judgments. But in Federalist 78, Hamilton stated that the courts were “to have neither FORCE nor WILL, but merely judgment.” He warned that there would be “no liberty, if the power of judging be not separated from the legislative and executive powers.”

I mentioned earlier that there are members of Congress who have expressed a preference for addressing grievances by statute rather than by constitutional amendment. This would be fine if statutes worked, but the record shows otherwise. Congress has repeatedly passed balanced budget acts (most notably Gramm-Rudman-Hollings) only to violate both the spirit and the letter of the law. More importantly, the Supreme Court can declare statutes passed by Congress to be unconstitutional. In Bowsher v. Synar, for example, the Court ruled that certain provisions of Cramm-Rudman-Hollings called for specific budget cuts that were executive functions, and therefore vested an executive function in a legislative branch officer, thus violating the separation of powers. Despite having taken this position in Bowsher, it took only four more years for the Court to trample seven centuries of history—from Magna Carta (1215) through the English Petition of Right (1628), the Fundamental Orders (1639), the English Bill of Rights (1689), the Declaration of Independence (1776), The Federalist (1787-88), France’s Declaration of the Rights of Man and of the Citizen (1789), the Confederate Constitution (1861), and the 50 state constitutions of our union —and to usurp the power to tax, clearly a legislative function, without the consent of the people.

Michigan State Senator Loren Bennett introduced Senate Current Resolution 273, which calls upon Congress to send to the states an amendment to the Constitution which would end judicial taxation. “What would be the point of our last 21 tax cuts,” he said, “if we allowed the courts to indiscriminately raise taxes? This practice is dangerous and must stop now.” Arizona State Senator Marc Spitzer, sponsor of Arizona Senate Concurrent Resolution 1014, was just as emphatic: “We need to send a message that the people of this country do not approve of Federal judges sitting as ‘Super Legislators.'” Spitzer understands that, unlike a statute, a constitutional amendment is definitive and final. It is the only way to stay the judicial hand when judges and Congress ignore the separation of powers. The amendment we propose reads:

Neither the Supreme Court, nor any inferior court of the United States, shall have the Power to instruct or order a State or political subdivision thereof, or an official of such State or political subdivision, to levy or increase taxes.

It is an undeniable truth that taxation is a political power. The Founders clearly intended that power to be exercised by the branch of government closest to and directly accountable to the people, namely, the legislative branch. Unless circumstances change, a constitutional amendment is the only viable remedy to judicial taxation.

Leave a Reply