The unipolar dominance of the American Empire has allowed it to command an outsized share of the world’s resources in exchange for green pieces of paper. That dominance, and the dollar’s hegemony, nears its end.

Since the end of World War II, the United States dollar has enjoyed the special status of global reserve currency. Coupled with the economic might of the American system—with its relative respect for property rights and admiration for the entrepreneur—the United States government was a giant on the global stage, not even having a close rival after the fall of the Soviet Union in 1991.

The politicians and bureaucrats who exercised temporary control of this state machinery proved to be very poor stewards of their inheritance, however. The American advantage has been squandered over the ensuing decades. I predict that by 2040 it will be obvious that King Dollar has been displaced, and the unipolar superpower of the United States will be but one player in a multipolar world.

Because the 13 American colonies were part of the British Empire, Americans originally used British currency, the pound sterling, as their official money—“sterling” referring to the fact that Great Britain’s currency at the time was redeemable in silver. Even so, the colonists imported and used money from all over the world. The most popular foreign coin was the Spanish silver dollar, with the word “dollar” being an Anglicized version of the German word for a silver coin, “thaler.” This history is why the Continental Congress and later the U.S. Constitution adopted the “dollar” as the new nation’s official currency.

To appreciate just how different the American monetary system was in its infancy, consider: From the birth of the Constitution through the eve of the Civil War, the U.S. federal government only issued dollars in the form of gold and silver coins. Specifically, individuals would take “raw” gold or silver to be minted into the appropriate denominations (such as a $1 silver coin, a silver quarter-dollar or “quarter” for short, or a $20 “double eagle” gold coin) at the respective weights and fineness as specified in federal legislation. Before 1861, if Americans wanted paper notes as money, they had to get them from a commercial bank. Such banknotes weren’t legal tender, but were mere claims on the actual money, which everybody knew was gold and silver.

The Civil War famously saw both North and South resorting to the printing press to fund their militaries; the paper “greenbacks” of the North were not redeemable in specie, and rapidly lost their value relative to full-bodied coins of gold and silver dollars. After the war, the victorious North passed legislation in 1873 that ended the “free coinage” of silver and hence ended the period of bimetallism; silver advocates would later refer to this as the “Crime of ’73.” Further legislation in 1875 required U.S. paper dollars to be redeemable once again in gold (at the pre-war rate of $20.67 per troy ounce) by 1879.

Once the U.S. dollar was again fully redeemable in gold by the late 1870s, the United States joined the growing number of countries that had likewise linked their sovereign currencies to specific weights of gold. This period through the eve of World War I constituted America’s time—and much of the modern world’s time—under a classical gold standard. Although the French authorities issued francs, the Germans issued marks, and the Italians issued lire, each of the major currencies had a strictly defined exchange rate with every other one, based on their underlying redemption weights in gold. If any government’s central bank printed too much of its sovereign currency, gold would flow out of its coffers to the other participants in the system. This kept strict limits on any one power inflating more rapidly than its peers.

World War I killed millions of men and it also killed the classical gold standard. The belligerents felt they needed to run their printing presses to fund the war. The United States was better behaved than the others, but it too put limits on U.S. dollar’s redeemability in gold during the war. Although the major powers ostensibly relinked their currencies back to gold in the 1920s, these were much weaker versions of a gold standard.

During the Great Depression of the 1930s, the major powers once again devalued their currencies. In the United States, the incoming Roosevelt administration confiscated most private gold holdings (including gold certificates) under threat of a massive fine and a 10-year prison sentence, and devalued the dollar by 41 percent such that an ounce of gold went from an official price of $20.67 to $35.

After World War II, the Allies adopted the so-called Bretton Woods system. This is best described as a gold exchange standard, where the United States still maintained large stockpiles of physical gold. Other countries, however, were encouraged to hold their own reserves in the form of U.S. dollars (or official claims to U.S. dollars, such as Treasury securities). Because the U.S. government pledged to redeem these dollar liabilities in gold upon request (at the rate of $35/ounce), the system still had the veneer of the old gold standard. Even here, however, a crucial difference was that in the Bretton Woods era, only central banks could redeem their dollars for gold; mere citizens or businesses had no such rights.

Eventually the temptations of running the printing press to finance various federal spending programs—including actual wars in Asia and metaphorical wars on poverty at home—proved too much, and the U.S. government gradually lost the ability to cajole its weaker peers to continually bolster their dollar reserves, rather than redeeming in hard gold. Richard Nixon famously threw in the towel when he announced on Aug. 15, 1971 that the U.S. would no longer honor its commitment to redeem dollars in gold.

Ever since Nixon’s closure of the gold window, various analysts have warned that the U.S. government and Federal Reserve’s foolhardy policies were paving the way for a collapse of the currency. Since that apocalypse has never occurred, many Americans have embraced a relieved complacency. Even though on paper it certainly seems like the authorities in charge of maintaining the value of the currency have thrown caution to the winds, things appear all right to those with short attention spans. The U.S. dollar is still king, with no major shifts in years.

Yet if we pull back and look at a longer stretch of history, we realize the full extent of the dollar’s erosion. For our purposes, I will present three main lines of evidence.

First, since we are assessing the dollar’s role as “global reserve currency,” let’s consider its share in official foreign exchange reserves, as reported by various countries to the International Monetary Fund. In a recent article making the case that the dollar is still the world’s undisputed, leading currency, staffers at the Federal Reserve pointed out that in 2022, the U.S. dollar accounted for 58 percent of total global foreign exchange reserves, while the second-place euro was less than half of that, with a 21 percent share.

Yet this very statistic shows just how rapid the dollar’s decline has been, because back in 2000, the dollar was a whopping 71 percent of global foreign exchange reserves, compared to only 18 percent for the second-place euro. In other words, in the span of just two decades, the dollar has shed 13 percentage points of its share of global foreign exchange reserves, or about one-fifth of its starting share. If this gentle but steady decline continues, the dollar will fall below the 50 percent threshold before 2040.

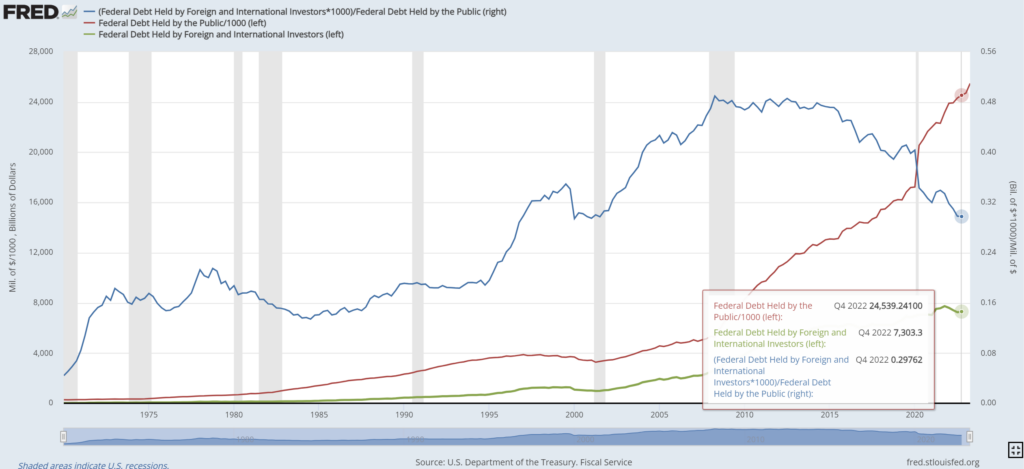

The second item for consideration is the distribution of U.S. Treasury debt among domestic versus foreign buyers, which is a measure of the willingness of the world to hold dollar-denominated assets. The chart above, generated online with the St. Louis Fed’s FRED data tool, shows three items: U.S. federal debt held by the public (the middle line, which spikes upward in the 2020s), U.S. federal debt held by foreign and international investors (the bottom line), and finally the ratio of the two series (the top line, until the end of the chart).

https://fred.stlouisfed.org/graph/?g=1afSQ)

As the chart indicates, foreign holdings of Treasury securities grew relatively faster than domestic holdings from the mid-1990s until the eve of the 2008 financial crisis. Specifically, foreign holdings grew from 20 percent in early 1995 to a peak of 49 percent in the second quarter of 2008.

In the immediate aftermath of the financial crisis, both domestic and foreign holdings of Treasuries rose rapidly, but the split between the two was roughly constant. Yet starting around 2013, it seemed foreign holders threw in the towel. They were finished adding to their stockpiles of Uncle Sam’s debt, as indicated by the relatively flat (bottom)line from 2013 onward.

Yet Uncle Sam certainly wasn’t finished issuing more debt, as shown by the rapidly rising (middle) line during the Obama years and then especially during Trump’s term when the coronavirus struck. It was strictly American buyers (including the Federal Reserve, which is counted as being part of the “public” in these statistics) who were loading up on this new debt. As the plunging (top) line reveals, the proportion of foreign holdings fell to 30 percent by the end of 2022.

The rapid ascent in U.S. interest rates may make Treasury securities relatively more attractive to foreign investors, but this increase in yield is counterbalanced by the escalation in the total debt accrued by the Treasury. According to the Congressional Budget Office, federal debt held by the public was a mere 39 percent of gross domestic product as recently as 2008; this year it is estimated at 98 percent of GDP and is expected to hit 119 percent by 2033.

And to be clear, this projected tripling of federal debt as a share of the economy over a 25-year period (from 2008 through 2033) doesn’t rely on any assumed recessions or financial crises going forward. It merely reflects CBO’s middle-of-the-road extrapolations of existing trends in demographics and the budget structure. Unlike the record level of debt held at the end of World War II, which gently faded as the economy recovered and the public returned to peacetime spending habits, our current fiscal mismatch isn’t due to a one-off emergency. It would take drastic and painful changes—including tax hikes and cuts to Social Security—to rein in our deficits and at least stop adding to the debt load. Yet precisely because such changes would be so painful, they likely won’t happen anytime soon. Foreign investors know this, meaning we probably won’t see a surge in demand to hold Treasuries on their part.

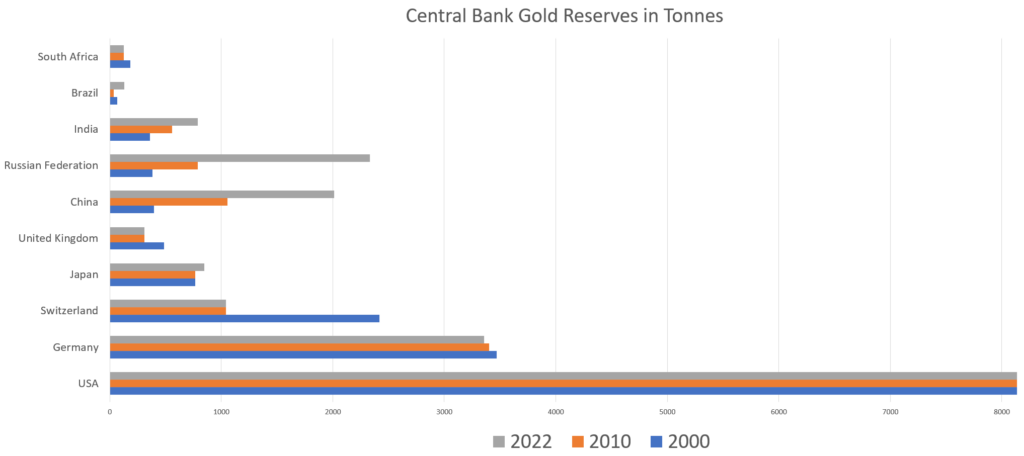

The third and final metric of the dollar’s status as a reserve currency we’ll consider is the amount of gold held in reserve by the world’s central banks. When contrasting the dollar against other fiat currencies, its slippage in prestige is partially masked by the fact that every other central bank has mismanaged its unbacked money as well. Looking at the stockpiles of physical gold held by various central banks can shed additional light on the subject.

https://www.gold.org/goldhub/data/gold-reserves-by-country

The table above shows official gold holdings in central bank reserves by various countries, as reported by the IMF and compiled by the World Gold Council.

In the top half of the above table, we can see that the U.S. and some of its economically strongest allies have either held steady or even reduced their physical gold reserves over the last two decades.

On the other hand, looking at the bottom half listing the so-called BRICS nations (Brazil, Russia, India, China, and South Africa), we see that all except South Africa have sharply increased their gold reserves. Keep in mind that the above table measures gold in physical weight; the market value of these reserves surged by a larger amount, even accounting for the general increase in prices since 2000.

In sum, if we look at gold holdings, it’s clear that a large share of the global economy is distancing itself from reliance on the dollar. Specifically, if we use the Purchasing Power Parity (PPP) method of comparing different currencies, then as of 2022 the BRIC block constituted a total of 31 percent of the global economy. The individual breakdowns were Brazil with 2.3 percent of global GDP, Russia with 2.9 percent, India with 7.3 percent, and China with 18.5 percent. For comparison, in 2022 the U.S. economy only produced 15.6 percent of global GDP.

A brief digression may clarify for those surprised at the above figures: There are two popular methods for comparing economic values that are measured in different currencies. The one typically favored by economists doing cross-country comparisons is to use the ratio that gives a unit of each currency the same ability to purchase a basket of consumer goods and services in each region. According to this PPP method, China became the world’s largest economy back in 2016, and as of 2022 had a GDP that was 18 percent larger than that of the United States. On the other hand, if we use official exchange rates to compare currencies, then as of 2022, U.S. economic output was still 41 percent bigger than China’s. Yet patriotic Americans should be wary of relying on these latter calculations, especially if they believe the Chinese government is artificially devaluing its own currency in order to promote exports.

As the above evidence confirms, we can confidently conclude that at least a third of the global economy is shifting away from the dollar. The motivations range from the purely fundamental analysis of debt burdens and fiscal sustainability, to more strategic concerns for political leaders who have seen the U.S. and its allies use dollar hegemony to punish their enemies through outright sanctions and more subtle financial measures.

My prediction is not that the U.S. dollar will necessarily be displaced by a specific rival—such as the Chinese yuan—but rather that the United States will forfeit its dominance, both in terms of its economic strength and the specific role of the dollar. Over the next 20 years, I predict that we will see a transformation from a world run by a sole superpower to a multipolar globe where various coalitions assemble around specific agendas.

For good or for ill, the American Empire is drawing to a close. The tremendous advantages held by the United States in the postwar era have been squandered. Over the past few decades, cynics would point to the mounting problems with the economic and military policies coming out of Washington, but after each passing crisis, a new normal would set in and lull most Americans back to sleep. Unless you have a good memory, it was easy to overlook just how deeply the American machine had sunk into the mud.

To take just one example: People of my age (I’m slightly shy of 50) grew up hearing about the coming crisis in entitlement spending, which always seemed to be a couple of decades in the future. Well, that crisis actually started back in 2010, when the Social Security program began experiencing cash flow deficits (meaning outgoing benefit payments exceeded the “contributions” from payroll taxes and taxes on benefits). With the continued aging of the population, drastic changes will need to occur to fix the mismatch between what Social Security owes to retirees and what it collects from current workers. The Social Security Administration’s own projection reveal that over the next 75 years, it will run a deficit equal to 1.3 percent of the entire country’s output. To repeat, that figure doesn’t refer to the overall federal budget deficit, but rather is merely the underfunding of Social Security (specifically, the Old-Age and Survivors and Disability Insurance funds).

Washington’s profligate spending will finally be curtailed as the dollar is dethroned. When central banks and other financial institutions around the world treated the U.S. dollar as good as gold, Americans enjoyed the “exorbitant privilege” (the derisive term coined by a French finance minister in the 1960s) of importing cars, oil, and textiles in exchange for sending back green pieces of paper, or even better just by altering some 0s and 1s in a database. Even in the midst of a global financial crisis that was arguably fueled by reckless Federal Reserve policies, the result was panicked investors fleeing to the world’s “safe asset” of U.S. Treasury securities. The U.S. authorities in particular, and the American people more generally, benefited from the U.S. dollar’s global reserve currency status just as a counterfeiter benefits from having a printing press.

The dethroning of the U.S. dollar will knock down the status of the U.S. government from a seemingly godlike entity, immune from the laws of scarcity and accounting that mere corporations, let alone households, must obey.

The analogy continues through to the end of the process. Just as it is painful to the counterfeiter when the community discovers his notes are fraudulent, in the long run the readjustment forces him to behave more honestly in his transactions. If he wants to buy something, he has to first earn the money to afford it, or at least borrow the funds knowing that he must work in order to pay the interest and principal down the road.

Americans will find themselves in a similar situation over the coming years. They will still benefit from the global division of labor, but it will be on more honest terms. The transition will be painful; the U.S. dollar’s value will fall against other currencies, meaning that “cheap imports” will no longer be so cheap. When there is a recession or other crisis, the U.S. government won’t be able to so casually throw a trillion dollars at the problem, because it will be Americans themselves funding the new debt through higher taxes and/or domestic prices.

In short, the dethroning of the U.S. dollar will knock down the status of the U.S. government from a seemingly godlike entity, immune from the laws of scarcity and accounting that mere corporations, let alone households, must obey. In reality, of course, the U.S. government has been subject to the laws of economics all along, but the dollar’s special status has managed to defer and camouflage the full impact of its decisions.

Every other empire in world history has risen and fallen, and the U.S. roller coaster has clearly gone over the hill and is now accelerating downward. Governments, companies, and households in the United States will need to realign their expectations and adopt more modest budgets going forward, but in the big picture this painful adjustment will be a needed return to reality.

Leave a Reply