“There once was a lady from Niger Who smiled as she rode on a tiger. They returned from the ride With the lady inside And the smile on the face of the tiger.”

—Ogden Nash

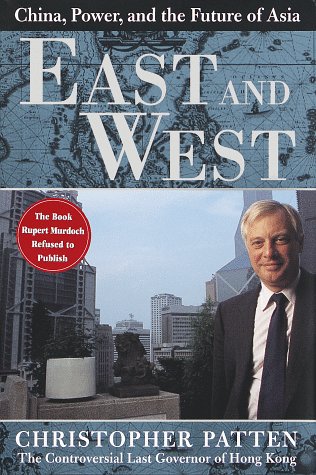

Christopher Patten warns at the start that his engagingly written book is not a memoir. Though the core of it deals with the author’s tenure as the British Empire’s final governor of Hong Kong (1992-1997), Patten employs an impressionistic and anecdotal approach that is better suited to interpreting history than merely to recording it. In this he performs a valuable service. Toward the end of the book, however, as he attempts to peer into the future. Patten strays from the path of experience into the theoretical world of political economy in ways that seem to contradict the strongest parts of his earlier argument.

The emergence of a more active China in world affairs troubles Christopher Patten.

Chinese society bears many of the hallmarks of early-twentieth-century fascism. . . . The military is very powerful; the tentacles of the Party (a clan of interconnected family interests, not an ideological movement) entwines every aspect of commercial life; nationalism and xenophobia have replaced moral zeal; the state is supreme.

Peking (which Patten uses in preference to Beijing “because there is a word in the English language for China’s capital”) has shown an increased assertiveness by its rapid military build-up and its threats against its neighbors. “China is rapidly becoming a threat to world peace,” he warns, “as well as an affront to our civilized conscience and an unfair competitor in global markets.” Patten advises the West to

stop cosseting China; use access to our markets as a carrot for good behavior and a stick for bad; stand unequivocally by Taiwan; keep up our military strength in the region; encourage Asian countries to keep up their own guard; speak out for the oppressed of China and work for freedom there; press China in every international forum to improve its behavior; refuse China “face” until China improves its behavior.

Patten’s is less a policy of “containment” than it is one of “disengagement”: The West should not contribute to China’s rise until the “inevitable” tide of liberalism transforms Peking into a capital that can be trusted. Though he does not I believe George Kennan’s admonition •2. “to have as little to do with China as possible” is as practicable as it was 50 years ago, nevertheless, “Kennan’s arguments cast at least a shadow of wisdom over current fixations.” In the near term, Patten is not scared “witless” by the People’s Republic of China because it still lags well behind the West, while, in the long run, he is optimistic: “China is at an end of an era. . . . What more does the Communist Party have to offer than cynicism and decadence?” The problem is— as always—maneuvering successfully from the near term to the long run. It has become fashionable to predict that China will become a liberal democracy in 15 or 20 years. The same, however, could have been said of Nazi Germany in 1938, and the prediction would have filmed out to have been right; but Germany came to democracy by way of war and subjugation.

German democracy is not the product of private enterprise and economic interdependence, as proponents of the United States’ present “engagement” policy argue will be the course in China. Indeed, Patten sees the Chinese business interest as a principal obstacle to national reform. The governor’s campaign in Hong Kong to create institutions of democracy and civil liberties to combat Chinese despotism earned him a reputation for being “bad for business,” while both Western and local businessmen felt that trade with China depended on keeping in the government’s good graces: “Political harmony was essential to business profits.” The head of a large British international bank warned Patten that he would mobilize other businessmen to boycott the Conservative Party unless the governor retreated from his reform program, while media mogul Rupert Murdoch canceled HarperCollins’ publishing contract with Patten upon learning that his book was critical of a Chinese regime with which Murdoch has strong—and growing—business ties.

Local entrepreneurs, whose rise to prominence is supposed to transform China, have proved no more independent. Patten calls Hong Kong businessmen (many of whom joined the General Chamber of Commerce in the legislature “to do their patriotic duty” on behalf of Peking) “shoe shiners” of the Peking regime. Thus, it was not difficult for Peking to recruit a billionaire shipping magnate as its Hong Kong satrap. The subservience of Hong Kong businessmen calls into question the argument of American businessmen that the continued appeasement of China is in Hong Kong’s best interest.

As transnational business interests have gained political influence in Western capitals, it is not surprising that China has become adept at manipulating the international situation. “Sophistication is not required,” Patten says.

Europe is played off against America; one European country is played off against another. Chinese views of the venality of the Western world, and of the controlling influence there of business lobbyists, must be one of the few aspects of modern life that continues to give any relevance or vitality to Marxist and Maoist thought.

The notion that foreign policy should focus on boosting the overseas prospects of nominally domestic business firms is far too narrow and short-sighted even if one construes national interest—or world order—purely in material terms. Patten cites two common instances in which the desires of business run counter to national security. One is the sale of nuclear technology to China, where it will not only be used to improve Peking’s nuclear arsenal but also be passed on to other regimes hostile to Western interests. The other one is the running up of huge trade surpluses, “part of which are spent [by Peking] on modernizing its military hardware,” while the West pretends it has no idea what is happening.

Yet, having blasted international business firms for their myopic greed and their baneful influence on government policies. Patten endorses the classical liberal theory of “free trade” as the stance appropriate to Western democratic governments in the future. By defining “free trade” as the conduct of business “free” from concerns for higher issues, whether moral or strategic. Patten typifies the confusion among mainstream conservatives who embrace capitalism in principle while professing to be appalled by the lack of principle among capitalists. The solution, of course, to this sup)- posed impasse is to acknowledge that, since business acts like business, government must act like government in protecting the national interest from all dangers, foreign and domestic—including those posed by business.

From the perspective of Hong Kong, “free trade” is a vital concept: As a city-state. Hong Kong had no alternative to a trade-dependent strategy. This has always been the plight of small states lacking the resources or population base to do more than play their part in the international division of labor. In times of general prosperity, and under the protection of larger powers, city-states can prosper. But because they lack the power to control the wider environment, they are extremely vulnerable to economic turmoil and political pressure: Hong Kong could not insulate itself from the Asian financial meltdown any more than it could maintain its independence from China. Great powers, by contrast, do have alternatives, which is what makes them great. The continental spread of the United States, with 265 million well-educated and affluent citizens developing and using state-of-the-art technology, makes it much less dependent on the “global” economy. With one-third of that economy in recession —the third most directly involved in “free trade”— the advantages held by a large country with a diverse industrial and commercial base have again become apparent.

Americans should be grateful that the United States is not Hong Kong. Yet the Clinton administration has attempted to emulate Hong Kong and the other Asian “tigers” by plunging into economic globalism. As the U.S. trade representative saw it in 1996, America was “a mature economy with few domestic opportunities for growth.” The fatal flaw in this pessimistic view is that it was always American consumer demand which fueled the export boom in Asia, not the other way around. The over-investment in export-oriented production all along the Pacific Rim drove down prices and profits, leading to loan defaults and currency devaluations on a massive scale.

Patten, who has yet to learn from the history of his own country, believes that “protectionism tries to stop the clock” and leads to “the delayed introduction of new technology.” But this is what happened in England at the dawn of the century, when British policy embraced “free trade” with a passion bordering on religious zeal. In his new work, The Wealth and Poverty of Nations, economic historian David Landes attributes England’s decline to the loss of export markets by an economy based on exports. Without an assured market, investment in new products and industrial methods waned. New occupations did arise, particularly in services, but, as Landes notes, “these new lines may not have the same social and economic values as older employments” (i.e., selling potato chips is not the economic equivalent of making computer chips).

The irony is that China, another continental-sized state that does not practice anything akin to “free trade,” will accelerate its rise to power as the Pacific Rim slides into depression. This shift in the regional balance of power will be aided by an American policy that continues to favor China at the expense of our natural allies on the Rim, refusing to intervene against the transnational corporations in order to fashion a strategy that brings moral values, national security, and economic policy into harmony.

[East and West: China, Power and the Future of Asia, by Christopher Patten (New York: Times Books) 304 pp., $25.00]

Leave a Reply