Why It’s Actually Okay to Live With Your Parents Now

I am the host of a nightly conservative political talk show on One America News. And I still live at home with my parents.

Perhaps that strikes some as hypocritical. After all, isn’t the right always accusing the young on the left of being basement dwellers who still live with their parents? Obviously, that invective is not fully without just cause. You don’t need to look at fancy graphs and statistics to know what your own eyes and your own life experiences can tell you: many millennials are infantilized by virtue of their baptism into the state religion of secular liberalism.

In my defense, home prices are really high right now, especially where I live in Southern California. Normal suburban tract homes are selling for well over $650,000—even starter homes, which just 20 years ago were selling for less than $200,000.

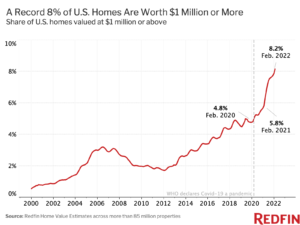

The rise of million-dollar homes (Redfin)

More than 8 percent of homes in the nation are now worth at least $1 million, according to a March study released by Redfin, a Seattle-based real estate brokerage. That is almost double what it was before the pandemic struck. The National Association of Realtors likewise found a whopping 15 percent increase in the price of homes over just the past year. As of February, the mean U.S. price for a home now stands at $357,000.

Many factors account for this spike, including the inflation rate, which in March reached 8.5 percent, a 40-year high. Housing is rising even more than other goods, however, due to the basic economic principles of increased demand and limited supply. The sudden switch to remote work in 2020 allowed many people the freedom to change geographical location and still remain connected to their jobs. And for those who were at first hesitant to take the plunge and move, record low mortgage rates may have been a decisive factor.

Another factor, not mentioned by Redfin, has been the political exodus of residents from largely blue cities and states into redder areas, following the rioting and crime sprees across the nation after the death of George Floyd and ahead of the 2020 election.

There is also the disturbing new trend of property-buying sprees by billionaires. Bill Gates has reportedly now become the largest private owner of American farmland, while a former member of the Chinese army has bought about 130,000 acres for a wind farm near a U.S. military base in Texas. Meanwhile, giant hedge funds are taking over suburbia.

A recent example of this came in the form of a CBS interview with Lesley Stahl and Gary Berman, the CEO of Tricon Residential. This Toronto-based company is now one of the largest owners of single-family rental homes in the U.S., with inventory sitting at more than 30,000 homes and a company mandate to buy at least 800 new homes each month.

What respectable nation allows a foreign company to snatch up homes from citizens, depriving them of the ability to put down roots and to build wealth?

Interestingly enough, Tricon’s home country of Canada is now banning foreign investors from buying homes for the next two years to help cool down its housing market. In many ways, Canada is to the left of the U.S. mainstream, yet any copycat action here in America would likely be stymied by cries from the left of xenophobia and bigotry and from the right of big government market interference.

Tricon Residential and similar companies employ a couple of methods to edge out normal home buyers. Either they out-bid other buyers by paying above market price, or they make their offer in cash and waive their right to see the home in person or to inspect it. What seller wouldn’t take that offer in a heartbeat?

Despite the outrage the Berman interview caused among many conservatives, CBS notes that there are companies even bigger than Tricon Residential:

Invitation Homes owns more than 80,000 rental houses, American Homes 4 Rent close to 60,000. Some of the all stars of finance—Goldman Sachs, JP Morgan, Blackstone—have put hundreds of millions of dollars into these companies.

Much of this phenomenon got a kickstart after the 2008 financial crisis, when many homeowners, underwater on their mortgages, gave up their homes to the banks, creating a large foreclosure inventory. Sensing an opportunity, investment firms snapped up bargain-priced homes, sending agents to courthouse auctions with duffel bags full of cash.

To be sure, the large majority of the U.S. housing stock is still owned by single-family residents. And the U.S. rental market is still dominated by small-scale landlords who own at most a few rental properties. However if current trends continue that balance could easily flip in the coming decades, and billionaire investors may be the nation’s largest landlords. In the meantime, home buyers are stuck navigating a competitive market with low supply and high prices.

In a recent appearance on my show, Tipping Point, Helen Andrews, senior editor for The American Conservative, made the observation that young people today are increasingly unsure of whether they will even be able to obtain the same quality of life as their parents. This flips the American dream on its head. Seemingly gone are the days in which a single income was enough to afford a home, kids, and fun outings.

A piece of advice repeated ad nauseam to young people by their elders is to rent an apartment with several roommates and to make-do eating Top ramen noodles for the foreseeable future. Hopefully, the thinking goes, by suffering for a few years, the frugal young adult will have saved enough money for a down payment on a house. That advice may have worked consistently

20 years ago, but today it can actually do more harm than good.

That’s because rents are so high, especially in America’s largest cities, that even living with roommates is unaffordable for many. Nearly half of all American renters spent 30 percent or more of their income on housing, according to a March Pew Research report that analyzed the most recent Census Bureau data. Even more shocking, nearly a quarter of all American renters spent at least half of their income on rent.

How are people supposed to save enough money for a home when they are paying the equivalent of a mortgage or more in monthly rent, and for a property they will never own?

The same Pew report goes on to note that the average U.S. rent has risen 18 percent over the last five years, outpacing the rate of inflation. This is how the “forever renter” cycle begins. Like the Red Queen in Through the Looking-Glass, renters must run faster and faster just to stay in the same place. And, like the World Economic Forum promises us with their Great Reset: we will own nothing and “be happy.” Eat the bugs; live in the pod. Predictions of the future tend to be off the mark (where is my flying car?), but this one rings eerily true.

There is also a social aspect to the forever-renter phenomenon that should make conservatives especially concerned. A growing population of rootless renters does not make for strong, grounded communities occupied by residents interested in seeing the local culture preserved. A generational problem emerges as well, as families who lack homes or farms have little that they can pass along to their children and grandchildren.

Remember, Donald Trump was pilloried during the 2016 presidential campaign for admitting that his father helped him get started in business by giving him a “small loan of a million dollars.” But that transaction was exactly correct. Wealthy families should help their children with loans, with home buying, and with job connections. That is how they keep wealth in the family. It would be unnatural to kick one’s kids out at 18 and to tell them to start from scratch.

So, if a young person is unmarried and can work within commuting distance, what is the point of moving out? Why eat dinner alone out of a to-go box in front of a screen, when you can share a meal at home with family? Why feel pressured to move out only to take on burdensome student loans from a college staffed by people who hate half of the nation? And why do it just to get a degree that is increasingly meaningless in the current work environment? There are plenty of ways to grow responsibly, both financially and emotionally, without putting oneself in the debtor’s hole.

To avoid that fate, families need to be more proactive by instilling values of faith in their children and by helping them financially, in a responsible way, to become independent. Living with my parents has allowed me to save up money that I will invest in my own family, when the day comes that I have one, so that I can avoid the forever-renter pitfall. Their help has not made me dependent; quite the opposite! As I save now in the present, my future financial independence grows daily more sure.

But there is another layer to this beyond the financial. Even though I am at a point in my life where I could afford to buy a home, I do not want to move away from my family, even if I were to move just down the street. I am a woman. I am an emotional creature. And I need companionship. Being alone would not be good for me, mentally. Therefore it doesn’t make sense to move out until I am married.

Meanwhile, I help my parents financially, and we spend quality time together. I’ve lost enough close family members to disease and accident to know that one thing money can’t buy is more time. I’m trying to spend it wisely.

Top image: Construction workers build new homes in Philadelphia on April 5, 2022. Low mortgage rates have helped juice the housing market over the past decade, easing the way for borrowers to finance ever-higher home prices. (Matt Rourke / Associated Press)

Leave a Reply