No one so much as pauses when the mob shouts down reasonable voices during a panic. Just witness the media’s daily performance during the COVID-19 crisis. CNBC hit the ejector button on author James Grant during a live broadcast when he wondered aloud if the government’s civil society shutdown might lead to more harm than good. Even after crises subside, no one defends that same voice of reason when he repeats his advice with the posterity of hindsight.

Luckily for humanity, several modern-day prophets persist without defenders. One prophet in particular, Nassim Nicholas Taleb, gloats at his opponents’ cowardice. He rubs his incontrovertible conclusions in the faces of those busy defending a status quo that enriches a select few at the expense of the common good—politicians with their power grabs, corporate executives with their bailouts, and academics with their burnished reputations from rewriting history during the maelstrom.

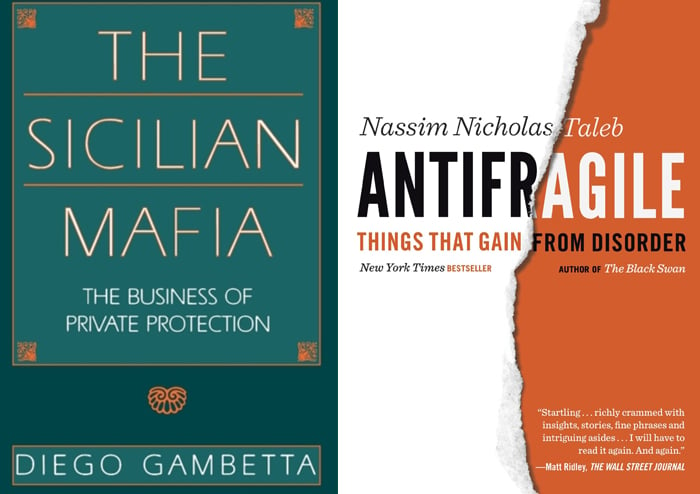

I coincidentally started reading Taleb’s Antifragile: Things That Gain from Disorder (2012) the week before the country melted down. Taleb argues for a third category beyond the easily broken and the resilient: the antifragile, a thing that, like a newly healed broken bone, becomes even stronger through shocks than it was in its original state. Far too much of modern society falls into the fragile category, a by-product of gargantuan size and a failure to build redundant systems.

Consider the massive American healthcare system now crashing headfirst into its design flaws. In order to meet investor demands and government edicts, the United States has a hospital system designed for profits, not problems. COVID-19 is another of Taleb’s ominous “Black Swans”: low-probability, high-risk events that are rare and devastating, but not unforeseeable. We ignore at our peril these cataclysms which are simultaneously unlikely and inevitable over a long stretch of time, like the 2008 financial crisis. In our shortsightedness, we don’t reward those who avoid losses.

As Taleb writes, “The true hero of the Black Swan world is someone who prevents a calamity and, naturally, because the calamity did not take place, does not get recognition—or a bonus—for it.” The U.S. could have built more hospitals, manufactured more ventilators, and stockpiled masks. But it didn’t. Until this latest predictable disaster struck, such moves reeked of paranoia and inefficiency to hedge fund managers, healthcare consultants, and Lizzo fans who prefer to believe whatever CNBC preaches.

Outside his cultlike following, Taleb’s warnings will sadly continue to fall on deaf ears. But Chronicles readers should enlighten themselves with Taleb’s insights. If I didn’t know any better, I’d have assumed he custom-wrote Antifragile for the readers of this magazine, given its abundant Latin and Greek phrases, quotes from Joseph de Maistre, and timeless wisdom.

—John Greenville

Perhaps because the current social order seems more fragile than ever, I’ve been drawn to economist Diego Gambetta’s 1993 masterpiece The Sicilian Mafia: The Business of Private Protection. This scholarly work published by Harvard University Press takes the novel approach of examining La Cosa Nostra in purely economic terms, as a black-market industry specializing in protection services, run by “entrepreneurs of violence.”

The subject of the mafia is inherently entertaining and fans of classic fiction from the genre, such as Mario Puzo’s The Godfather (1969), will find much of interest in Gambetta’s book despite its dry, cerebral presentation. Drawing on meticulously footnoted historical research and contemporary police records, Gambetta outlines the mafia’s growth in the 19th and 20th centuries from the lawless transitional period between feudalism and democracy. The book provides tables of statistics outlining the median ages of mafia bosses and their apparent occupations, from sheep breeders to undertakers and to bar owners; maps tracking the mafia’s spread from rural areas to the cities of Corleone and Palermo; and anecdotes about the political and business dealings of the so-called Men of Honor.

However, Gambetta’s purpose in these anecdotes is to illustrate how mafia dealings follow classic business concepts. Orderly markets; customer demand; reputational effects such as trademarks, branding, advertising; competition and barrier to entry; informal regulation and industry standards—Gambetta finds a correlation between nearly every aspect of conventional economic behavior and mafia operations. The comparison is enlightening, not only in that the mafia runs much like conventional business and government, but also in that business and government seem to operate like the mafia.

Another lesson in The Sicilian Mafia, which may not be what Gambetta intended, makes the book a classic for libertarians and anarcho-capitalists to this day: the emergence of spontaneous order from social chaos. Some of these people, annoyed at the presumption of sainthood conferred on today’s civil servants, would rather replace them with made men who burn images of saints as part of their initiation. Gambetta even calls out the great Austrian School economist Murray Rothbard in his introduction: “He seems oblivious to the fact that the society he is proposing exists already in Sicily and can hardly be described as a success.” Both sides of that argument should read Gambetta.

—Edward Welsch

Leave a Reply